“Even if growth is slowing, the market scale is still significant. It would not be wise to abandon efforts in China entirely.”

“Instead, we need to reduce costs and promote institutions more precisely to the right Chinese students.”

The Chinese outbound education market is evolving—fast—and so must the strategies of those who wish to thrive within it.

Here are the key takeaways from the session:

Traditional destinations face increasing pressure

Student visa enrollment rates for Chinese students have declined in the US, UK, and Canada, with only Australia and New Zealand experiencing growth. While some traditional destinations tighten policy, others—especially in Asia—are opening up to Chinese students with more favourable conditions.

“Recent headlines from the US and visa caps in Canada are making families pause,” Su Su noted.

“In contrast, countries like Japan, Korea, and Malaysia are stepping in with simplified processes and supportive policies.”

Implication for educators: Competing effectively now means offering a clear value proposition, greater flexibility, and smarter engagement—not just prestige.

Traditional destinations face increasing pressure

Student visa approval rates for Chinese students have declined in the US, UK, and Canada, with only Australia and New Zealand experiencing growth. While some traditional destinations tighten policy, others—especially in Asia—are opening up to Chinese students with more favourable conditions.

“Recent headlines from the US and visa caps in Canada are making families pause,” Su Su noted.

“In contrast, countries like Japan, Korea, and Malaysia are stepping in with simplified processes and supportive policies.”

Implication for educators: Competing effectively now means offering a clear value proposition, greater flexibility, and smarter engagement—not just prestige.

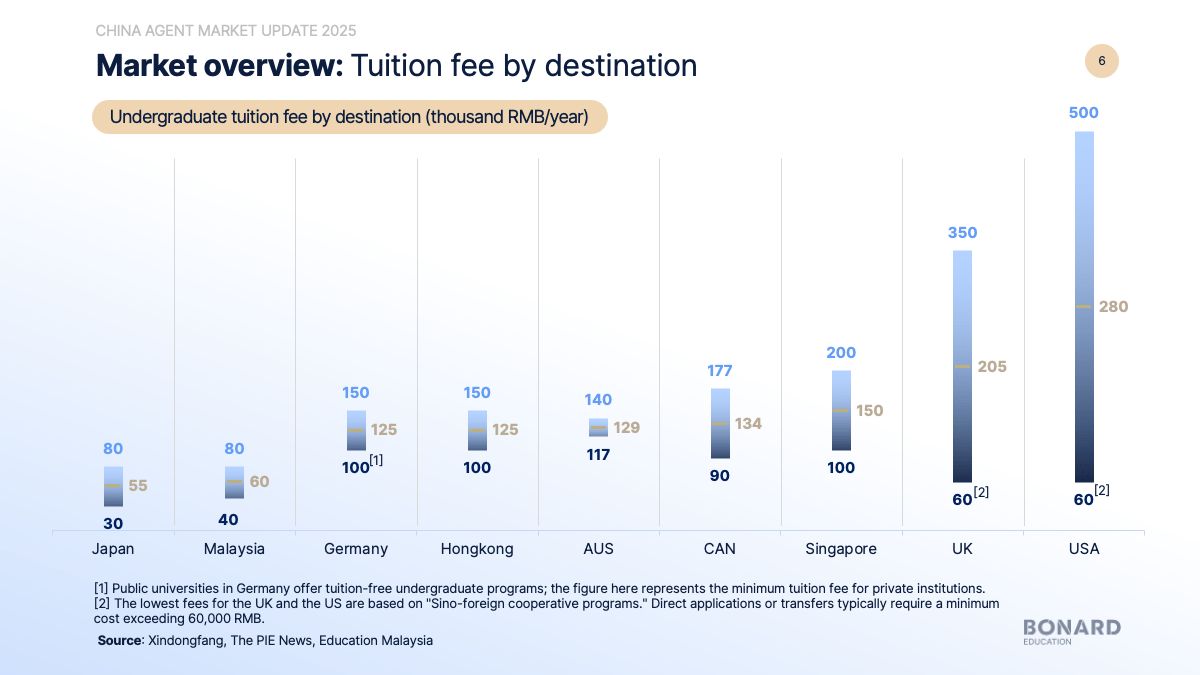

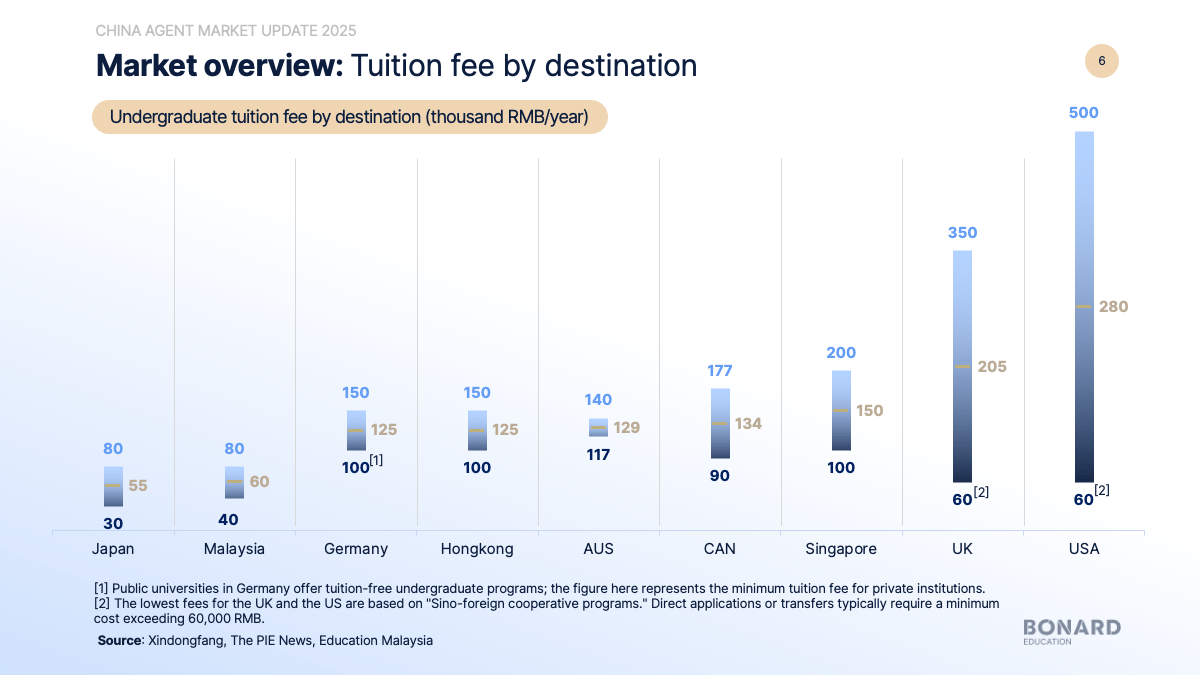

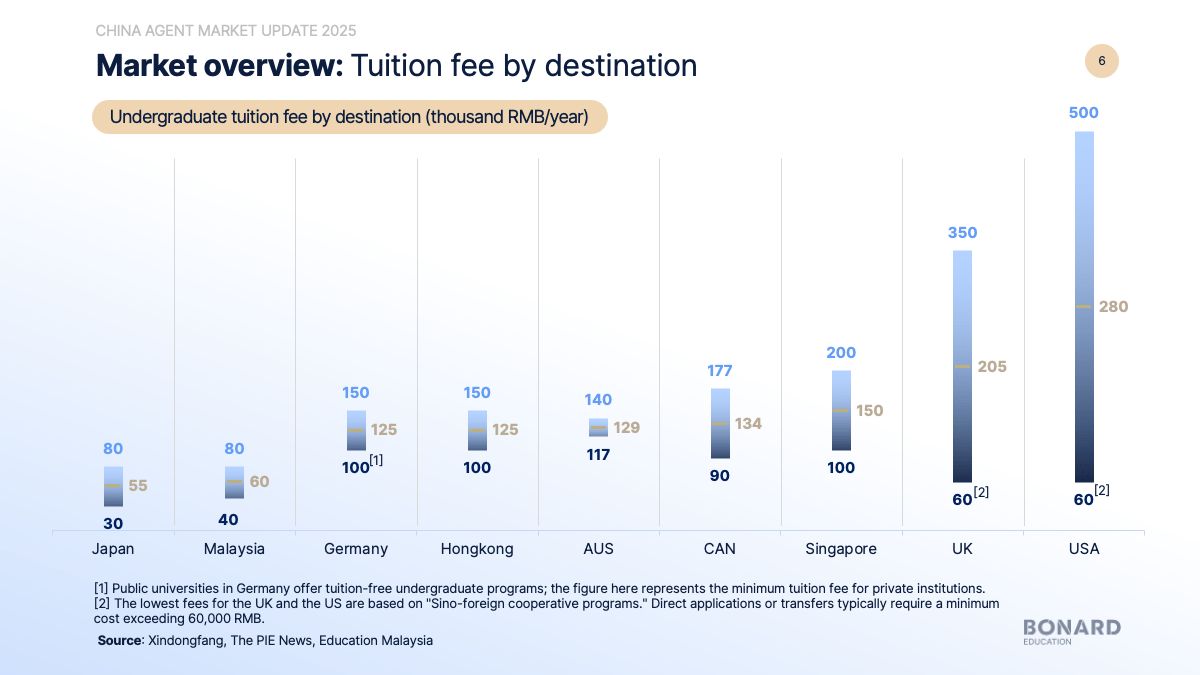

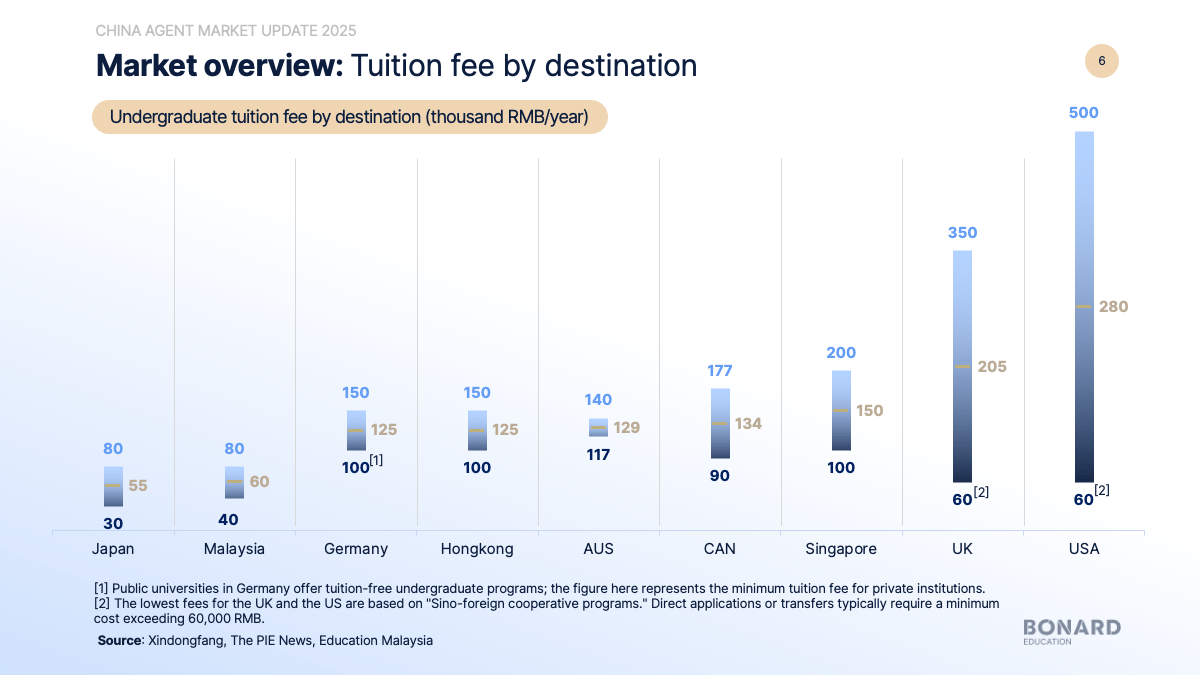

Cost is now a central decision driver

Amid China’s economic slowdown and record-high youth unemployment, families are becoming far more value-conscious.

A degree in the US can cost up to 10 times more than one in Malaysia, and study tour costs show similar disparities. Japan, Malaysia, and Hong Kong are rising as affordable alternatives.

“Families still prioritise international education,” Su Su explained,

“but they’re shopping smarter.They’re comparing every yuan spent to long-term returns—internships, post-study work, career outcomes.”

Implication for educators: Emphasise value. Showcase clear outcomes, scholarships, career pathways, and alternative formats like “2+2” or pathway programs.

Cost is now a central decision driver

Amid China’s economic slowdown and record-high youth unemployment, families are becoming far more value-conscious.

A degree in the US can cost up to 10 times more than one in Malaysia, and study tour costs show similar disparities. Japan, Malaysia, and Hong Kong are rising as affordable alternatives.

“Families still prioritise international education,” Su Su explained,

“but they’re shopping smarter.They’re comparing every yuan spent to long-term returns—internships, post-study work, career outcomes.”

Implication for educators: Emphasise value. Showcase clear outcomes, scholarships, career pathways, and alternative formats like “2+2” or pathway programs.

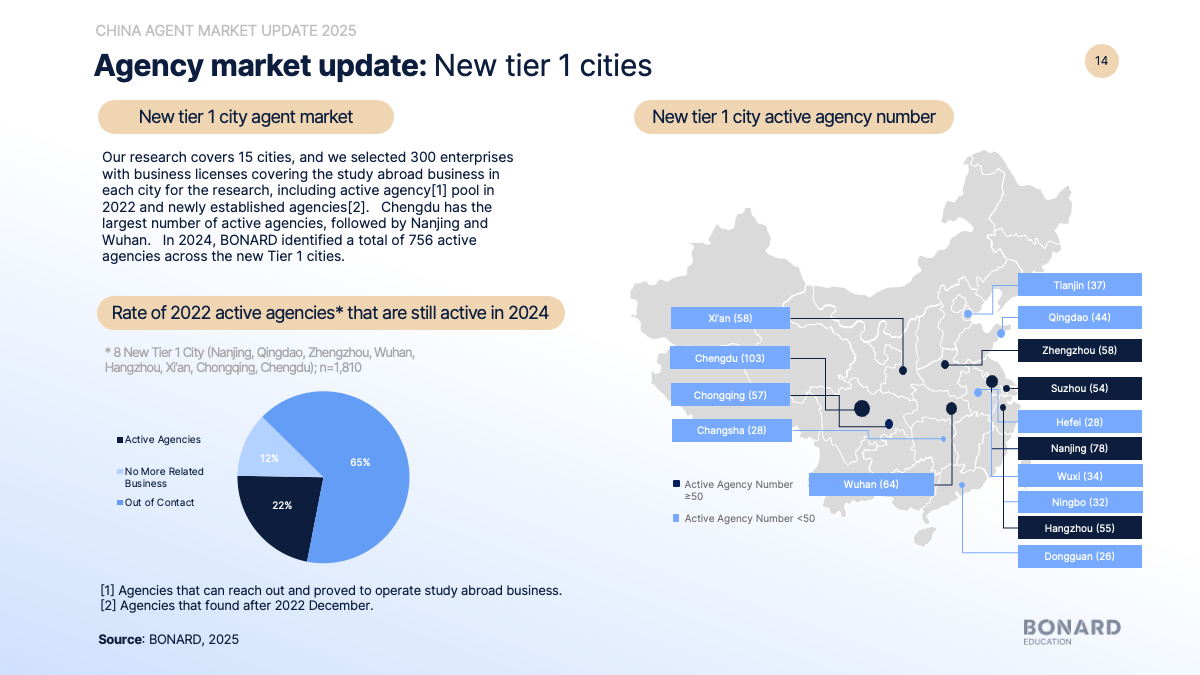

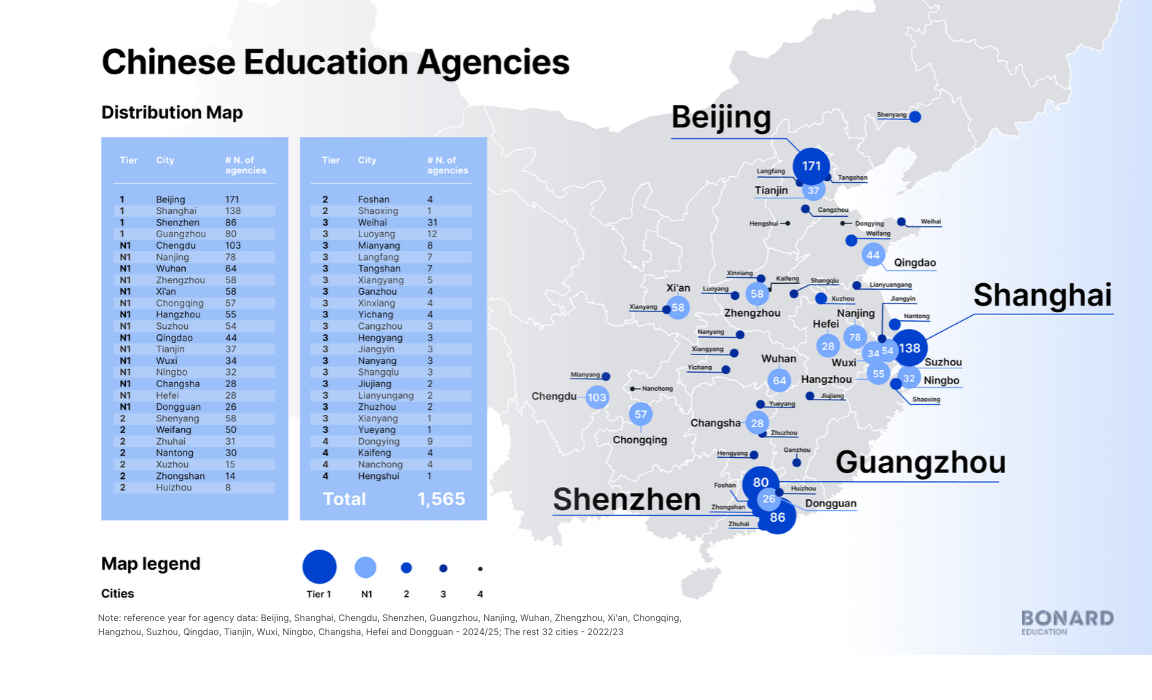

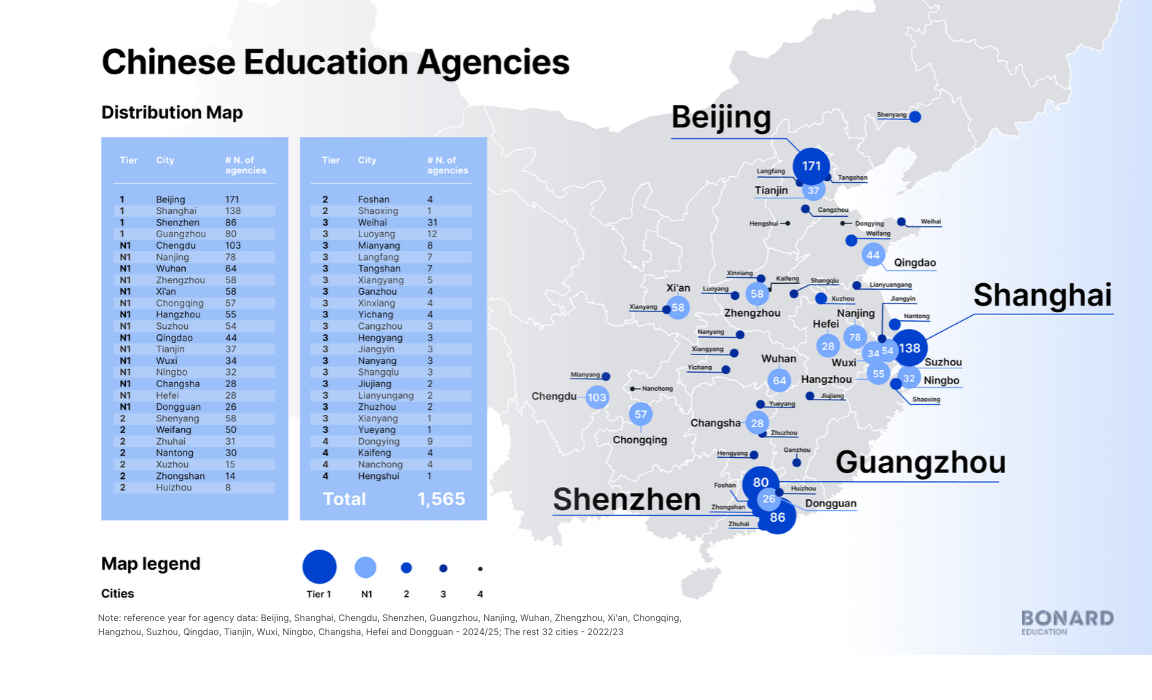

China's education agency landscape is rapidly evolving

BONARD Education’s updated China Agency Map revealed a key shift: only 44% of agencies active in Tier 1 cities in 2022 are still operating today. Simultaneously, new agencies are entering the market, particularly in cities like Beijing, Chengdu, and Nanjing.

We sampled over 6,000 companies and confirmed that 1,231 are actively placing students abroad—critical players in the ecosystem. These are the gatekeepers to Chinese student recruitment, especially for families who rely on trusted guidance.

“Agencies are no longer stable fixtures,” said Su Su. “You need to monitor who’s active, who’s influential, and who aligns with your goals.”

Implication for educators: Continuously monitor and reassess partnerships. The agency network is no longer static.

China's education agency landscape is rapidly evolving

BONARD’s updated China Agency Map revealed a key shift: only 44% of agencies active in Tier 1 cities in 2022 are still operating today. Simultaneously, new agencies are entering the market, particularly in cities like Beijing, Chengdu, and Nanjing.

We sampled over 6,000 companies and confirmed that 1,231 are actively placing students abroad—critical players in the ecosystem. These are the gatekeepers to Chinese student recruitment, especially for families who rely on trusted guidance.

“Agencies are no longer stable fixtures,” said Su Su. “You need to monitor who’s active, who’s influential, and who aligns with your goals.”

Implication for educators: Continuously monitor and reassess partnerships. The agency network is no longer static.

“Hibernation mode” is the new normal for many agencies

Facing economic pressure and fewer student inquiries, many agencies are scaling back marketing and focusing on internal capacity-building and training. They are actively seeking new overseas partners, but cautiously.

This presents a valuable window for institutions: during slower cycles, agents are more receptive to new collaborations, training, and strategic planning.

“Several agencies described 2025 as a year to reset. They’re waiting for stability—but also looking to partner with institutions that support them long-term,” Su Su shared.

Implication for educators: Engage now. Train agents, invest in long-term relationships, and provide materials in Mandarin to strengthen positioning.

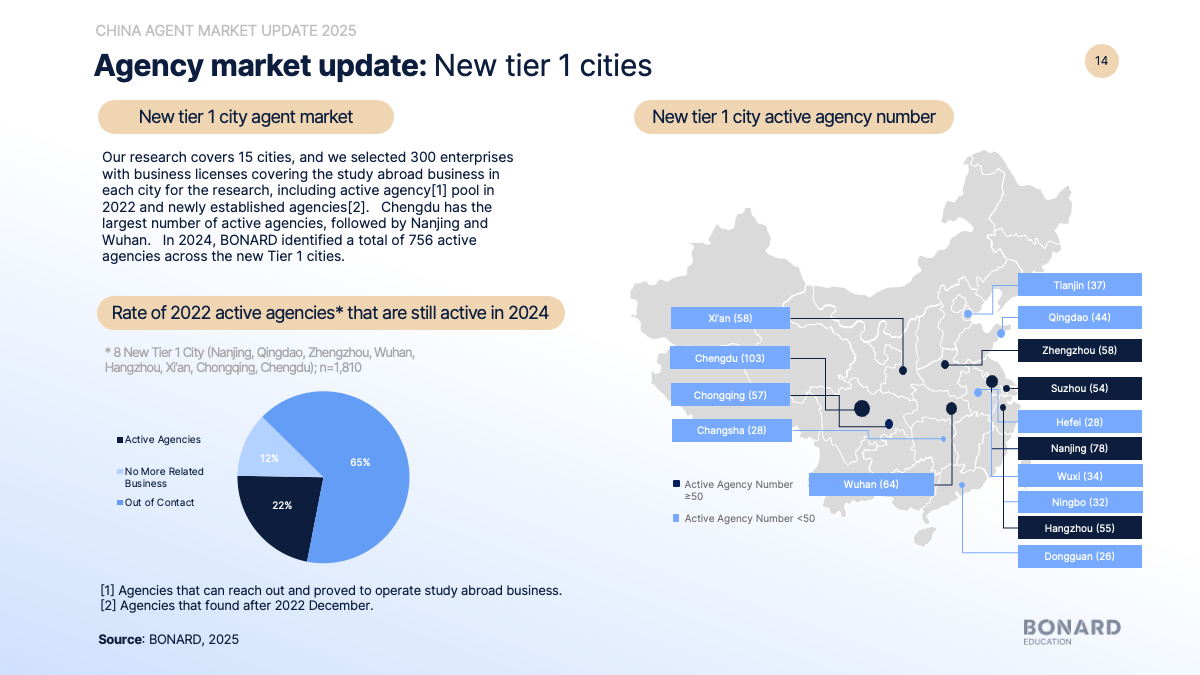

Diversification beyond Tier 1 cities is growing - but cautiously

While Beijing and Shanghai remain key hubs, our research into New Tier 1 cities shows growing activity—but with higher volatility.

Only 22% of agencies active in 2022 are still operating today. Nevertheless, cities like Chengdu, Hangzhou, and Zhengzhou show strong student potential, tied to rising Gaokao participation and expanding middle-class populations.

“It’s a fast-moving market,” Su Su said. “Start with Tier 1 cities where the ecosystem is stable, then expand based on your bandwidth and data. The demand is there—you just need to map it carefully.”

Implication for educators: Tier 1 cities remain the safest bet, but targeted expansion into second-tier markets can yield strong returns—with the right data and partners.

Families still value the “big four”—but expectations are higher

Yes, many Chinese parents still favour the UK, US, Canada, and Australia. But their expectations are evolving.

They want:

Career-aligned programs

Shorter and more flexible formats

Clear post-study work options

Transparent pricing and tangible ROI

Meanwhile, interest in local-university + overseas-experience programs is rising rapidly—joint degree and mobility programs offer a cost-effective alternative.

“We’re seeing a real shift,” said Su Su. “It’s not just about prestige—it’s about what happens after graduation. Can this degree help my child get a job? Is there a work pathway?”

What’s next?

As our research shows, China is no longer the “easy goldmine” it once was. The market is still large—but institutions need to work smarter, not just harder.

BONARD recommends six strategic shifts:

Accept and adapt

Understand the new reality and move fast.

Refine your strategy

Use data to target by city, student type, and program.

Adapt strategies to affordability

Focus on cost-effectiveness and ROI.

Invest in partnerships

Train, engage, and localise support for agents.

Localise your efforts

Materials in Mandarin, staff with local knowledge, and on-the-ground presence matter.

Diversify

Beyond Tier 1 cities and even beyond China—stay agile and informed

What’s next?

As our research shows, China is no longer the “easy goldmine” it once was. The market is still large—but institutions need to work smarter, not just harder.

BONARD recommends six strategic shifts:

Accept and adapt

Understand the new reality and move fast.

Refine your strategy

Use data to target by city, student type, and program.

Adapt strategies to affordability

Focus on cost-effectiveness and ROI.

Invest in partnerships

Train, engage, and localise support for agents.

Localise your efforts

Materials in Mandarin, staff with local knowledge, and on-the-ground presence matter.

Diversify

Beyond Tier 1 cities and even beyond China—stay agile and informed

EXPLORE MORE WITH

BONARD Education Platform

CHINA AGENT MARKET 2025 - ANNUAL UPDATE

Webinar Recording

CONTACT FORM

Webinar - Sign up form

Secure your spot today and find suitable partners in China education market

Webinar schedule:

Presentation by BONARD (45 mins) Q&A session (15 mins) Do you want to learn more about the presented data? Explore our data platform - the most advanced source for international education market intelligence.