That process of returning to pre-COVID patterns of outbound student mobility received another surprising boost when the government announced on 28 January that it would no longer recognise credentials earned via online study (for programmes where students would normally be learning in-person abroad) and that students should “return to school as soon as possible”.

That policy change has left many students scrambling to secure passports, visas, flights, and accommodation to return to campuses in the UK, US, Canada, Australia, or other overseas destinations. Speaking at a special webinar on the topic on 9 March 2023, Igor Skibickij, chief operating officer for industry research consultancy BONARD, estimated that 3,500 students returned to Australia in January alone while as many as 40,000 additional students had still been trying to travel to the country for the start of the new academic year in February.

“The backlog of visa [processing], the shortage of international flights, the lack of available accommodation, these are the new problems for Chinese students to face,” said Mr Skibickij. “And it appears the sector is not entirely prepared.”

At the same time, the webinar also highlighted impressive examples of foreign educators taking steps to smooth the path back to campus, including New Zealand universities reserving up to 400 seats on charter flights for returning Chinese students.

Shifts in demand

Mr Skibickij described a declining pattern of demand for pathway programmes among Chinese students – that is, programmes abroad combining language or other preparatory studies with degree studies – that began before the pandemic and appears to be extending into this year.

“The pandemic has actually caused a compression effect where Chinese students are looking for more cost-efficient or time-efficient study options overseas,” he said. “Pathways do not seem to represent the same ROI [for students],” he added in a context where students may have less time or budget for extended programmes abroad.

The situation is exacerbated by the expanded, improved provision of English Language Teaching (ELT) programmes within China. “Even in the last three years, many providers have invested in the market and established robust English tuition capabilities [in China],” he explained. “All of this should eventually stimulate further demand for study abroad.”

Mr Skibickij noted as well that while demand remains strong at both the undergraduate level and for advanced degrees, a combination of rising unemployment and slowing economic growth is creating a more competitive labour market at home and further driving demand for overseas study, especially for postgraduate courses.

The big picture

BONARD reports that there were a total of 1,061,511 Chinese students studying abroad in 2021 (although we can understand that this number captures both students on campus overseas as well as those studying remotely from within China during the pandemic).

The research team notes as well the impact of the geopolitical climate on patterns of outbound mobility, with cooling relations between China and the US, Canada, and Australia likely playing a part in recent-year trends.

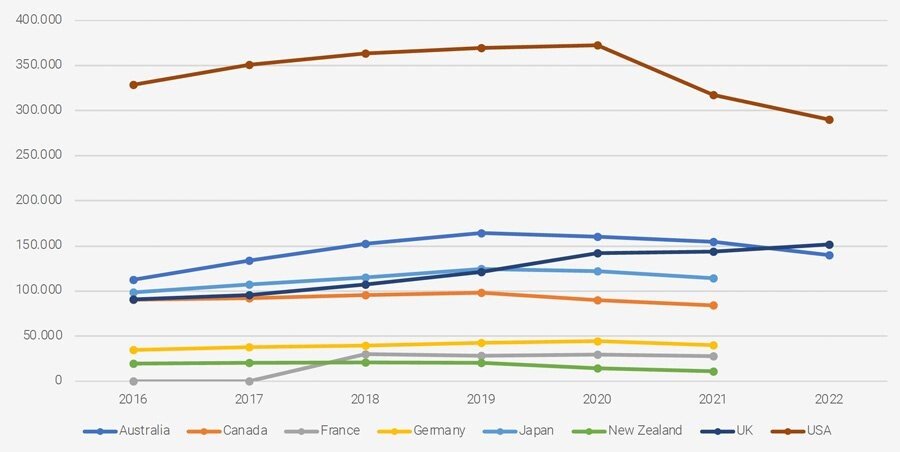

As we see in the chart below, all three countries have reported declining Chinese numbers, even before the onset of COVID-19. Meanwhile, the UK, which has not only a refreshed post-graduate work offer but also a more positive bilateral relationship with China, has seen steady growth.

Number of Chinese students in higher education overseas, selected destinations, 2016–2022. Source: BONARD

Number of Chinese students in higher education overseas, selected destinations, 2016–2022. Source: BONARD

Even so, BONARD reports that more than seven in ten Chinese students going abroad will choose to study in a major English-speaking destination.

“China remains the largest [sending] market for most destinations and will probably remain so for the foreseeable future,” concluded Mr Skibickij. “We probably haven’t seen the peak of demand yet and these recent [policy] changes should only further encourage Chinese students to return [to campuses abroad].” But with increased competition from destinations in Europe and elsewhere, he cautioned, educators can expect to compete harder for Chinese students going forward.

Based in part on findings from their recent survey of Chinese parents and students, BONARD advises educators in the higher education sector to emphasise the educational quality of their university and programme alignment with labour market trends. Student services and career supports are noted in the survey findings as increasingly important to Chinese students while cost of living is now also noted by Chinese students and families as a top decision factor. The research team also noted school reputation and safety as key factors for parents planning to send K-12 students abroad.