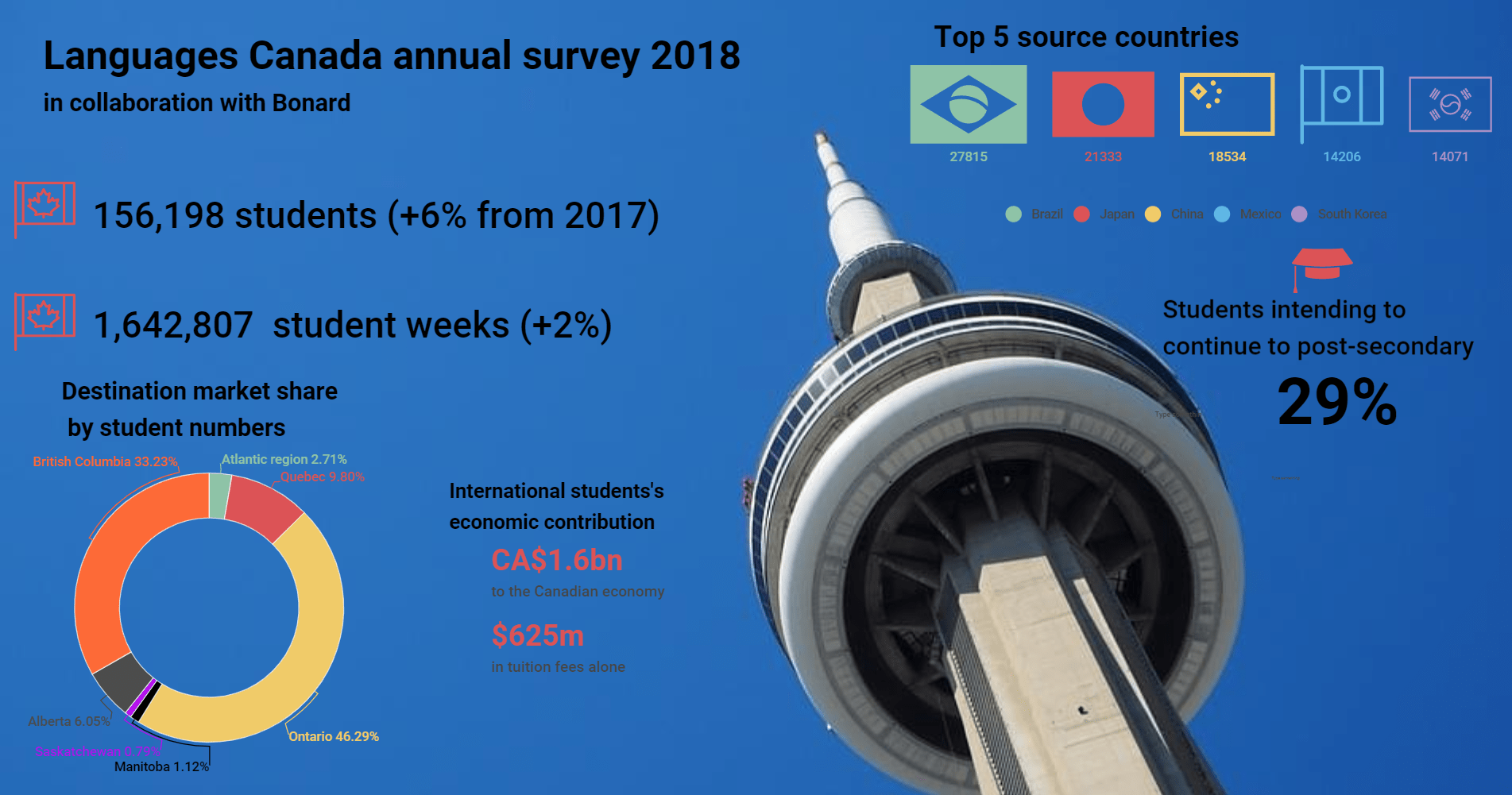

Carried out by BONARD, the survey shows that student numbers for Languages Canada members rose to 156,198, accounting for a total of 1,642,807 student weeks.

For the first time, the survey attempted to map the entirety of the language teaching sector in Canada, reaching out to schools who are not members of Languages Canada.

Out of an estimated 352 language programs in Canada, the survey’s 214 responses from Languages Canada members and 30 from non-members show that Canada hosted 166,847 language students in 2018.

For Languages Canada members, the growth was driven mostly by public sector providers, who saw a 21% year-on-year growth in student numbers and 13% in student weeks.

Meanwhile, private sector members rose by 2% in student number volume, but student weeks shrank by 2%.

The associations’ executive director Gonzalo Peralta told The PIE News that while the loss of long-term students from Saudi Arabia and difficulty for Chinese students in obtaining visas for private sector schools have played a role in this trend, the most important factors may still be government policy exacerbating international competition.

“Probably, the most influential factor is the continued flow of students to countries that offer access to work as part of the language learning experience,” he said.

“At a national level, lack of access to work by eligible students at accredited language programs has resulted in an estimated 15% loss for Canada’s language education sector.”

“In some provinces, legislation and regulation either do not recognise private language programs or create an uneven playing field,” he added.

For the whole sector, the damage caused by the absence of work rights is exemplified in Brazilian students’ trend towards choosing shorter stays and fewer pathways, which Peralta stated there is “nothing unclear” about in the introduction to the report.

Asked how the international education sector can come together to support this valuable pipeline of enrolments, Peralta said that improving and increasing pathways is “one of the most important issues international education can tackle.”

“It has to be done at three levels: institutional, sector representative bodies, and governments,” he explained.

At CBIE, director of knowledge mobilisation Jacquelyn Hoult told The PIE that the organisation sees “tremendous value” in pathways and that their success on the collaboration of all players.

“Whether it is a language school, international school, school board, college, technical institute, university, organisation, industry partner, or government, the success of pathways rests on the collaborative efforts of those involved to identify and strengthen pathways that create opportunities across the sector,” she said.

Beyond international competition, domestic competition and visa processing times and refusals were the most commonly reported challenges for LC members, with the highest numbers of visa refusals affecting Brazil, China, the first and third source market respectively, and Turkey.

As in 2017, in 2018 the top five source markets were Brazil, Japan, China, Mexico and South Korea, with the latter the only to report a decline (-6%) from 2017. Vietnam registered another impressive growth, jumping from 10th to seventh position with a 62% increase.

French language programs welcomed 18,136 students, with domestic students representing just over half of the population. The top source markets for these programs outside of Canada were Brazil, China, Mexico and the US.