Headline data: The English UK 2025 Student Statistics Report shows that in total there were 333,440 full-time face-to-face students in 2024, which was a 0.5 per cent decrease compared with the previous year.

There were 1,150,255 student weeks delivered in 2024, which represented a 0.9 per cent decline against 2023 weeks. The average stay was 3.4 weeks.

Juniors made up a record 62 per cent of all students in 2024, surpassing 60 per cent in the previous year. However, adults still dominate the volume of student weeks, accounting for 67 per cent of weeks delivered. The average stay for adults was 6.0 weeks, compared with 1.9 weeks for juniors.

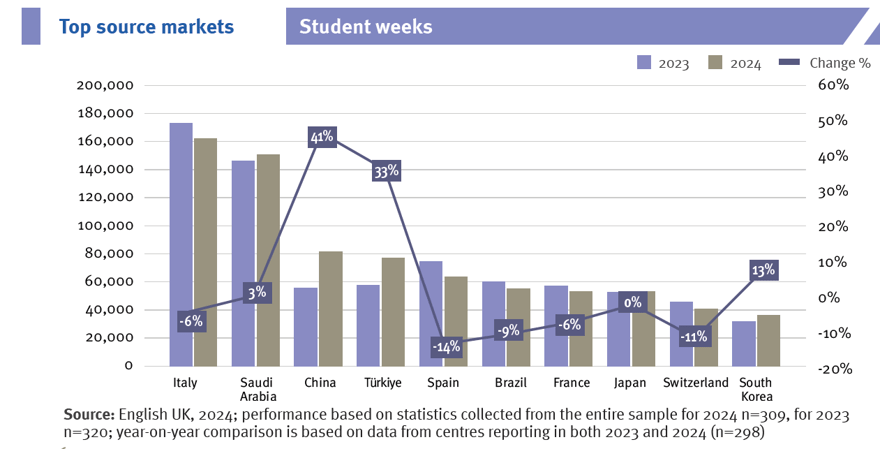

Student weeks in the top ten source markets in 2023 and 2024. Source - English UK/Bonard.

Ivana Bartosik of English UK’s intelligence partner Bonard said, “In a year marked by global uncertainty, significant government interventions and projected double-digit declines in affected ELT destinations, the UK sector held steady. While overall growth remained flat, this consistency amid international turbulence reflects the UK sector’s enduring appeal and ability to adapt.”

Source markets: Italy, traditionally the top source market for English UK centres, remained in number one position in 2024 with 81,847 students, a 8.4 per cent decrease compared with the previous year, followed by Spain on 13,594, which was a drop of 13.8 per cent.

The top five was completed by China (25,910, +58 per cent), France (20,492, -9.5 per cent) and Germany (18,629, -8.6 per cent).

By the measure of student weeks, Italy was also the top source country on 161,983, which was down by six per cent, followed by Saudi Arabia (150,702, +three per cent), China (81,367, +41 per cent), Türkiye (76,807, +33 per cent) and Spain (63,438, -14 per cent).

Nine of the top 20 source markets for UK ELT delivered a year-on-year increase over 2023 in student weeks, with China (+20,129 weeks) having the largest absolute increase, followed by Türkiye (+18,782 weeks) and Colombia (+6,309).

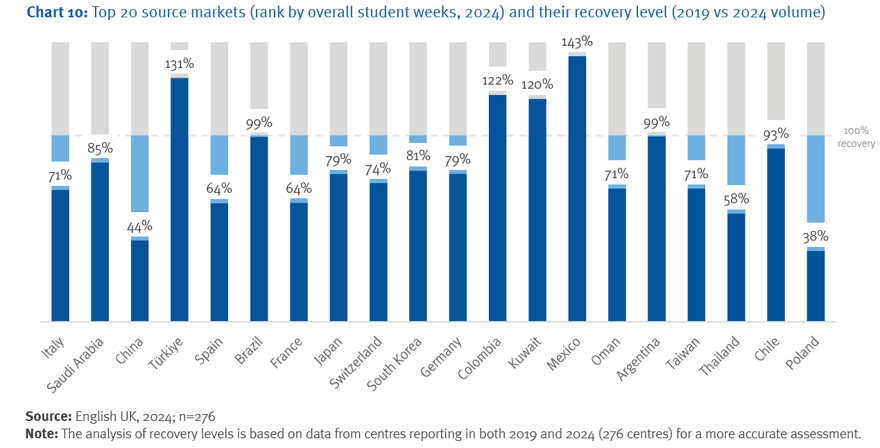

Market recovery vs 2019: Of the top 20 source markets, only four exceeded 2019 student week volumes in 2024: Mexico (143 per cent recovery); Türkiye (131 per cent); Colombia (122); and Kuwait (120). However, Brazil and Argentina were both on 99 per cent of pre-pandemic weeks, while Chile (93) was also close.

Poland had the lowest level of weeks compared with 2019 at only 38 per cent, the English UK research shows, followed by China on 44 per cent.

2024 vs 2019 student week volumes in the top 20 source markets. Source - English UK/Bonard.

2024 vs 2019 student week volumes in the top 20 source markets. Source - English UK/Bonard.

Mixed fortunes: The report demonstrates the disjointed year for the sector, with 44 per cent of the 309 member centres registering growth while 54 per cent experienced a decline in 2024.

English UK said that collectively members reached 76 per cent of their pre-pandemic student volume in 2024. It found that 79 member centres surpassed 2019 student week figures in 2024, while a further 36 members experienced a recovery between 80 and 100 per cent. In contrast, 83 providers delivered less than half of 2019 student week volumes in 2024.

Public/private sector: The decline of ELT in the public sector further education colleges and universities continued in 2024, with an 8.9 per cent drop in student numbers to 8,164 and a 14.5 per cent decrease in student weeks compared with the previous year to 74,549. The state segment has decreased every year since 2019, English UK said.

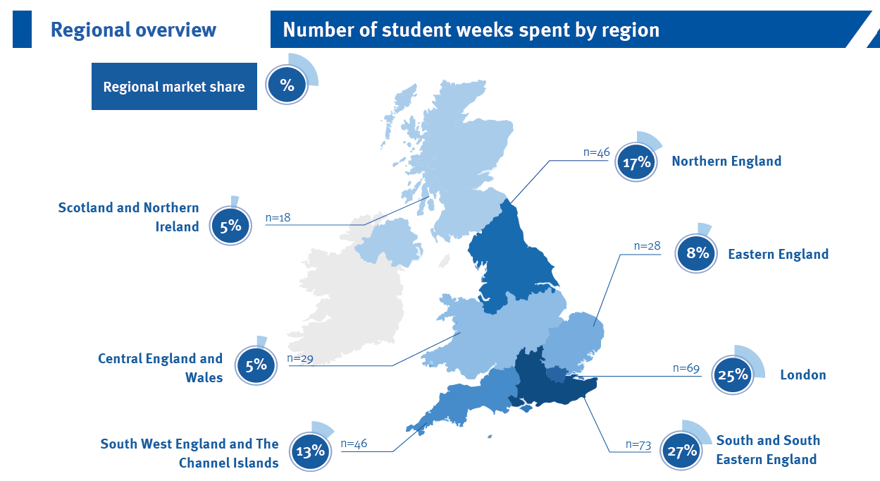

The spread of student weeks by region in 2024. English UK/Bonard.

For the state sector, China was the top source market by student numbers with 2,854, followed by Japan (791), Italy (465), and Saudi Arabia (307).

Private sector members registered a slight decrease of 0.7 per cent in students, and growth of 0.2 per cent in student weeks.

For private sector centres, significant growth markets by student numbers included China (+72.7), Türkiye (+29.3). Mexico (+34.8), Ukraine (+22.9), Russia (+33.1), and Hong Kong (98.1).

Regions: The South and South Eastern England region, which includes Brighton, Oxford and Canterbury, was the largest host region by student weeks, accounting for 27 per cent, followed by London (25), Northern England (17), and South West England (13).

Looking ahead/lobbying for support: Bonard and English UK have projected that the sector will remain “broadly stable” in 2025, although performance at an individual centre level is expected to “show considerable variation”.

The release of the English UK 2025 Student Statistics Report comes a day after English UK held a parliamentary reception and officially launched a new position paper and economic research that estimates the sector contributing almost UK£2 billion to the economy.

Chief Executive Jodie Gray said campaigning for measures to support the sector and stimulate growth will now be stepped up. “Our priority is to improve the operating environment for our members, and ensure our industry continues to benefit the UK both financially and diplomatically.

“We are using evidence from the economic impact report and the student statistics to intensify our campaigning and lobbying efforts for our members and our industry, and we will further expand the scope of our market intelligence. We are exploring ways of adding more forecasting to our market intelligence as well as identifying and acting on areas of greater potential."

In the position paper – which will be examined in greater depth in a separate StudyTravel Magazine story – English UK sets out six recommendations of how the government can support the sector, including: expanding travel opportunities via the youth mobility scheme; extending ID card travel for EU groups; and increasing rent-a-room tax relief to boost homestay capacity.

CONTACT FORM

Find out how we can cater to your specific needs

We look forward to assisting you further and explaining how our services can benefit you.