The report, conducted by market research company Bonard and presented in an online seminar last week, largely focusses on ten cities in China – Chengdu, Chongqing, Hangzhou, Wuhan, Xi’an, Nanjing, Zhengzhou, Changsha, Shenyang, Qingdao – as main hubs for development of the international education market.

Igor Skibickij, Chief Operations Officer at Bonard, said the 10 cities have an average of 18 per cent population less than the age of 14 years old, and that an increasing proportion of adult citizens are at least high school graduates and represent potential clients for international educators.

Of the cities profiled, Hangzhou has the highest average monthly income at US$837, according to China National Statistics Bureau 2021 statistics, followed by Nanjing (US$717) and Chengdu (US$714).

Some 126,889 entities are officially permitted to do study abroad-related business in 15 profiled cities in China (those mentioned above plus Tianjin, Suzhou, Dongguan, Hefei and Foshan), although the vast majority are not active or no longer exist, and only around 20,000 are actively doing study abroad business, the presenters said. This figure includes organisations such as language schools, immigration agents and travel agents as well as regular study abroad agencies.

Chengdu, one of the ‘New Tier 1’ cities profiled in the research.

Of these, 4,200 agencies were successfully contacted by the authors, via website/social media presence or phone calls, and these represent “the transparent part of the industry” and the “tip of the iceberg” Igor said.

Igor commented that the agency sector in China is very flexible and that as soon as there is a positive stimulus in the outbound market, companies will come out back to the agency business and new organisations will proliferate.

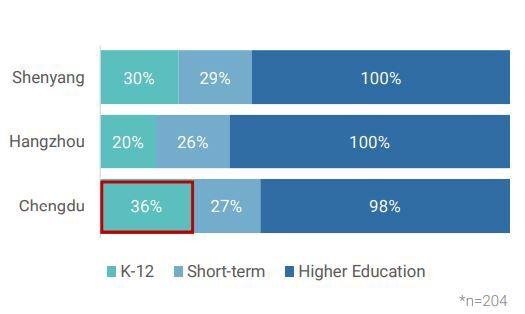

Bonard presented detailed profiles of three of the cities to demonstrate differences in the markets and the current impact of Covid-19: Shenyang, Chengdu and Hangzhou.

Of 219 agencies profiled across the three cities, 137 have been established since 2015, showing the relatively recent growth of the sector in those areas.

The pandemic has slowed the establishment of new study abroad companies, however. Only 12 agencies were founded in 2020, compared with 42 in the prior year, and only one new agency has been established so far this year.

Shenyang has 414 reachable companies with permission to do study abroad-related business, and of those only 14 per cent are operating as usual, 35 per cent have pivoted to other sectors and 51 per cent are currently out of contact.

All of the agencies here promote higher education, 30 per cent promote K-12 and 29 per cent are currently offering short-term programmes. The US is the top destination for agencies in the city, promoted by 70 per cent of the 56 companies profiled, followed by Australia (64), Canada (63), the UK (59) and Japan (52).

Grace Zhu, China Branch Manager for Bonard, said that Shenyang – located on the east coast – is closer to Japan, and that Japanese higher education was popular here for its lower costs than traditional English-speaking destinations.

Sectors offered by agencies n Shenyang, Hangzhou and Chengdu. Source – Bonard.

Chengdu has 427 reachable study abroad businesses, of which 20 per cent are currently operating as usual – a higher ratio than in other cities. Grace commented that agencies here have a more stable source of students and were less impacted by Covid-19.

There was also more interest in K-12 secondary programmes in Chengdu, with 36 per cent of organisations promoting this sector. The USA was the most promoted destination (69 per cent), followed by the UK (61), Australia (58), Canada (48) and Japan (35).

There was also more interest in K-12 secondary programmes in Chengdu, with 36 per cent of organisations promoting this sector. The USA was the most promoted destination (69 per cent), followed by the UK (61), Australia (58), Canada (48) and Japan (35).

Nearly all agencies profiled offer higher education programmes overseas.

Hangzhou has 548 currently reachable study abroad agencies, and of those only 14 per cent are currently operating as usual. While all of those offer higher education, there is less interest in K-12 (20 per cent) and short-term programmes (26). The USA is again the most popular destination for agencies here, promoted by 75 per cent, followed by Australia (62), the UK (60), Canada (60) and Japan (41).

Of the agencies in these three cities, 76 per cent were ’small’ single-office agencies, 18 per cent have between two and five offices, and six per cent are classified as big agencies, with six or more offices.

Across the three cities, more than three quarters (76 per cent) are not currently promoting online courses. However, those in Hangzhou were the most likely to be offering online products, with 56 per cent in the city indicating that they are, compared with only nine per cent of agencies in Shenyang.

From in-depth interviews with 56 agencies, it was found that 72 per cent sent only 30 or fewer students overseas in 2020, but contributors noted an increase in enquiries this year and higher expectations for the 2021/22 academic year.

The report was based on screening of government resources, company registers and company activity, 4,500 phone calls to agencies, and 90 in-depth interviews.