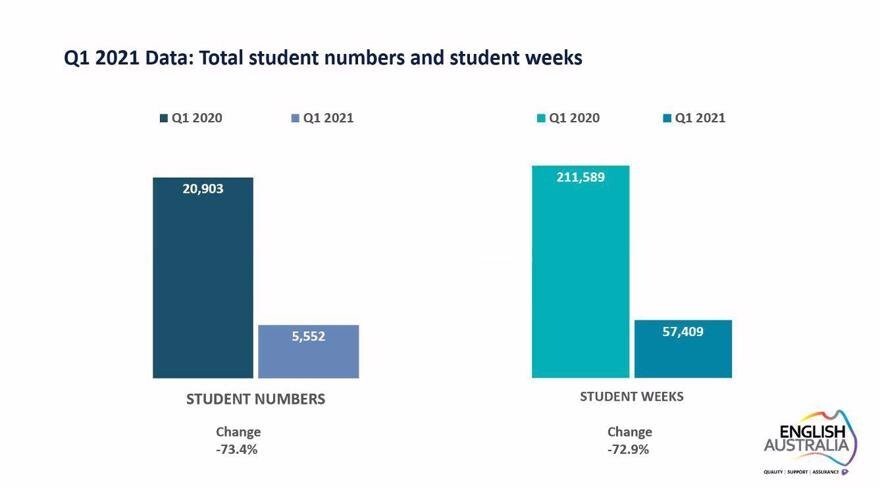

The report, which covers all types of English language student and visas, shows that the number of students enrolled decreased by 73.4 per cent to 5,552 for the participating institutions in 2021 Q1, compared with the same period of the previous year.

Student weeks delivered in 2021 Q1, meanwhile, declined by 72.9 per cent to 57,409 weeks.

Student numbers and student weeks in 2020 Q1 and 2021 Q1. Source – English Australia/Bonard.

Student numbers and student weeks in 2020 Q1 and 2021 Q1. Source – English Australia/Bonard.

English Australia recently reported a 47 per cent decrease in ELICOS students in 2020 overall, but in a news story and video interview with StudyTravel Magazine Brett indicated that bigger losses were imminent as the pool of potential onshore students dried up.

China remained the top source market for the providers in the 2021 Q1 period, despite a 51 per cent decrease to 1,887 students, followed by Japan (-82), Colombia (-69), Brazil (-80) and Korea (-78).

By study location, almost half of the students enrolled in Q1 (47 per cent) were located outside of Australia, while 53 per cent (2,760 students) were physically studying in Australia.

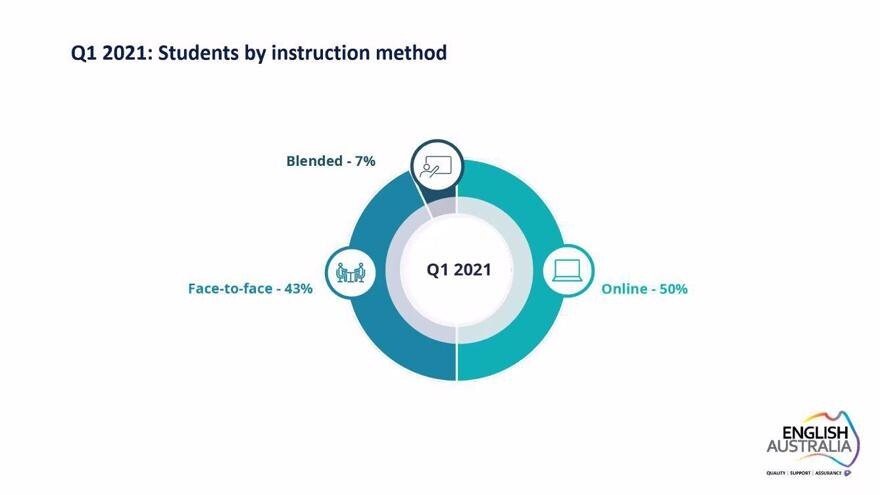

In terms of delivery method, the authors found that half (50 per cent) of students were studying online in 2021 Q1, while 43 per cent studied fully face-to-face and seven per cent were on blended learning programmes.

Offshore students studying online are categorised in the ‘other’ visa group, which became the second-largest cohort of students in Q1 (23 per cent) after student visa holders (73 per cent).

Agents became an even more important as a recruitment channel in 2021 Q1, the report shows, accounting for 87 per cent of students, compared with 80 per cent in the first three months of 2020.

New South Wales remained the largest host state of ELICOS students, but providers in NSW also suffered the biggest decrease in 2021 Q1, down by 77.8 per cent compared with the same period last year. ELICOS schools in South Australia had the smallest decline at 66.1 per cent.

ELICOS-only private English language centres were the most affected type of provider, registering an 82.2 per cent decrease in student numbers in the Q1 survey compared with the same period last year.

University English language providers were the least affected (-65.1 per cent) and therefore became the largest school type in 2021 Q1 by student numbers with 2,484 students. In his presentation, Brett indicated that the lower drop for this type of school could be attributed to greater success in enrolling online, offshore students.

University English language providers were the least affected (-65.1 per cent) and therefore became the largest school type in 2021 Q1 by student numbers with 2,484 students. In his presentation, Brett indicated that the lower drop for this type of school could be attributed to greater success in enrolling online, offshore students.

For ELICOS-only providers, Colombia became the largest source market in Q1, despite a 42 per cent decrease compared with 2020 Q1, followed by Brazil (-61 per cent), China (-78), Japan (-85) and Korea (-17).

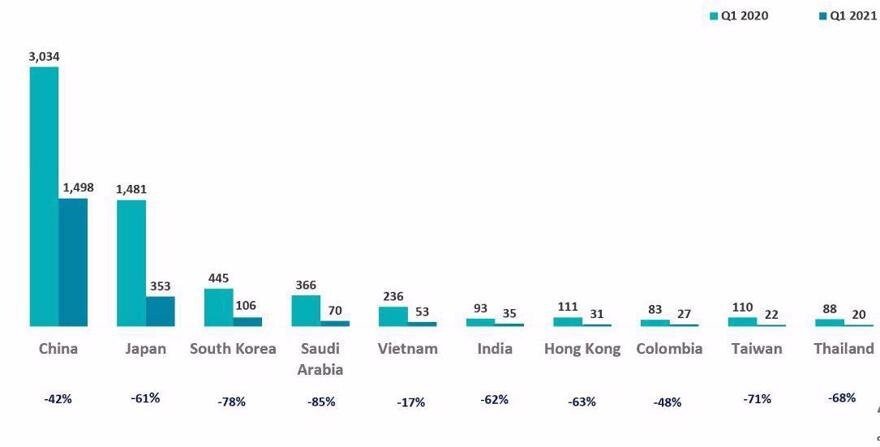

Top source markets for university English language programmes in Q1 2020 and Q1 2021.

Top source markets for university English language programmes in Q1 2020 and Q1 2021.

For universities English language centres, China was the top source market in Q1 (-42 per cent), followed by Japan (-61), Korea (-78), Saudi Arabia (-85) and Vietnam (-17).

English Australia also presented data on the impact on employment in the sector, and found that 22 per cent of employees in the sector have lost jobs as a result of Covid-19, and 41.5 per cent have been affected in some way (including reduced working hours and/or salary or staff leave requirements).

Of those that have lost jobs, 40.6 per cent were seasonal workers, 31.6 per cent were part-time employees, and 27.8 per cent were full-time staff.

Brett noted that this survey was conducted prior to the end of Australia’s JobKeeper support scheme, so a more damaging picture may emerge in the next quarterly survey.