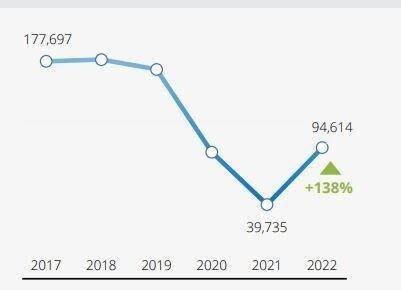

Headline data: The National ELICOS Market Report 2022 released by English Australia shows that English language providers hosted 94,614 international students in 2022, an increase of 138 per cent compared with the previous year, but still 44 per cent below the 2019 total of 169,864.

Student weeks, meanwhile, increased by 220 per cent compared with the previous year to 1,581,247 in 2022 – 32 per cent below the pre-Covid total of 2,317,823 weeks.

The stronger recovery of student weeks was boosted by a longer average stay of 16.7 weeks in 2022 – a substantial increase over 12.5 weeks in 2021.

The economic impact of the ELICOS sector last year was AUS$1.4 billion last year, still 40 per cent below 2019.

ELICOS student numbers from 2017-2022. Graphic source – English Australia/Bonard.

Source markets: Colombia became the largest source country for Australia’s ELICOS sector for the first time with 13,032 students, a 214 per cent increase compared with the previous year. China slipped to second with 10,956 per cent, growth of 11 per cent, while Thailand increased by 727 per cent to 10,945 students, becoming the third-largest market. The top five was completed by Japan (10,901 students, +273 per cent) and Brazil (9,656 students, +329).

By region, Europe had the highest year-on-year growth at 294 per cent, followed by the Americas (+248), the Middle East and North Africa (+208), Asia Pacific (+93) and Sub-Saharan Africa (+23).

Source market recovery: Looking at recovery level of the top 20 markets (2022 vs 2019), Turkey (+146), Thailand (+133) and Argentina (+117) exceeded pre-Covid student numbers, while Pakistan (96) and Colombia (90) came close.

Asian markets such as China (30), Korea (33) and India (30) had the lowest rates of recovery.

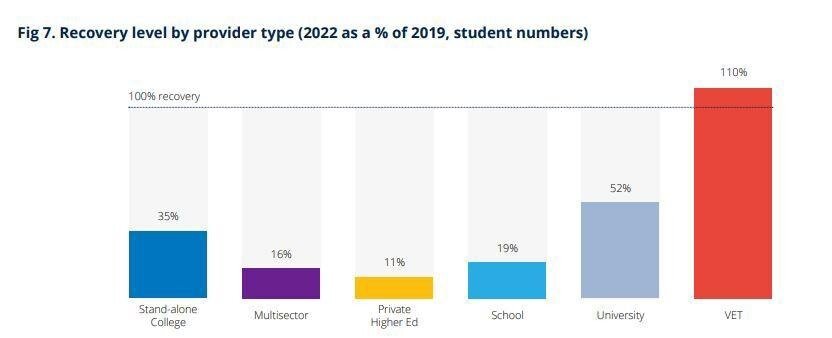

Recovery by provider type: The report also revealed an uneven recovery among different types of ELICOS provider. VET colleges actually exceeded 2019 levels last year, while universities recovered to 52 per cent, and stand-alone ELICOS colleges returned to 35 per cent.

Brett Blacker , CEO of English Australia, told StudyTravel Magazine, “The rapid growth from Colombia, Thailand and Brazil supported the strong level of market recovery for colleges that deliver English and vocational courses.”

VET colleges accounted for 51 per cent of students last year, while stand-alone colleges hosted 26 per cent – well below the share of 42 per cent in 2019.

Recovery by state: Providers in Queensland had the largest year-on-year growth at 227 per cent, followed by Victoria (+154), New South Wales (+109), Western Australia (+93) and South Australia (+65). By student numbers, New South Wales remained the largest host state with 35,664 students.

Despite the comparatively lower growth last year, South Australia has achieved the highest level of recovery at 69 per cent of student numbers and 147 per cent of student weeks.

Recovery level by provider type (2022 vs 2019). Source – English Australia/Bonard.

Recovery level by provider type (2022 vs 2019). Source – English Australia/Bonard.

Visa type: Student visas accounted for 78 per cent of all students at ELICOS providers, which was a slight increase over previous years. However, there was a change in the non-student visa categories. Visitor visas accounted for eight per cent of students, and working holiday visas represented seven per cent. The ‘other/no visa’ category, which during Covid years accounted for a larger share due to online study, declined to seven per cent last year.

Student type: Adult students represented 96 per cent of students in 2022, with the junior segment yet to return to pre-pandemic market share of nine per cent in 2019. Similarly, 97 per cent of students were individual bookings and only three per cent came as part of a group.

Brett said that colleges are reporting an increase in group tours in the current year, particularly from Japan and China.

Agent recruitment: In terms of booking channels, 86 per cent of students were attributable to agents, a slightly lower ratio than the 88 per cent recorded in 2021. Schools in Western Australia had the highest ratio of agent usages at 93 per cent.

Challenges: Providers said that difficulties in hiring/retaining qualified staff was the largest challenge faced in 2022, cited by 74 per cent, followed by visa processing times (49), accommodation shortages (41) and student visa refusals (35).

Further recovery in 2023: Data from the current year will give providers greater hope of full recovery in the coming year. Brett said, “2023 is looking very positive based on the YTD March student visa commencements of 32,563 above the pre-pandemic (2019) levels of 30,580. The Independent ELICOS visa pipeline for lodgements and grants are at record levels.”

In the year-to-date 2023 commencement data, the growth from Colombia has continued apace, up by 993.7 per cent compared with the same period last year, while Spain (+636.9 per cent), Brazil (+574.2), Mongolia (+465.9) and Chile (+378.4) all recorded strong growth.

Looking at former number one source market China – which relaxed its own Covid entry restrictions at the beginning of this year raising hopes of a recovery of the short-term study market – Brett said, year-to-date student commencements for March 2023 were up by 58.4 per cent compared to the previous year.

“Colleges are reporting that Chinese student commencements have improved further in the mid-year intakes, which are not yet reported in the published data.”

English Australia activities: Commenting on how the association is supporting the further recovery of the sector, Brett said, “English Australia maintains a strong collaborative relationship with the Department of Home Affairs to ensure efficient visa processing.

“We are currently investigating ways to assist our members in accessing offshore market development opportunities.”

He added, “English Australia is actively involved in discussions with the Australian government regarding the evaluation of the migration system, the inquiry into international education and tourism, and the ESOS reform process. It is imperative that the significance of our English language teaching sector is acknowledged throughout these reviews.”