The National Elicos Market Report 2021, prepared for English Australia by research partner Bonard, was completed by 152 colleges, and covers all student types at English language providers.

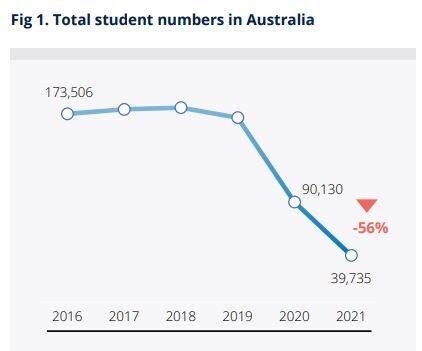

2021 headline student data: The report shows that there were 39,735 students enrolled in 2021, a 56 per cent decrease compared with 2020 and less than a quarter of pre-pandemic levels.

Student weeks meanwhile, declined by 59 per cent in 2021, compared with the previous year, to 494,783.

The decline in student numbers for Australia's ELICOS sector. Source - English Australia/Bonard.

Presenting the findings during a special webinar, Brett Blacker , CEO of English Australia, said that student numbers were at a 20-year low in 2021, which signified the impact of border closures on the ELICOS English language sector.

Sector value: The economic value of the sector fell by 61 per cent last year to AUS$439 million. The decline in value was greater than the drop in student numbers due to the fact that many students were offshore and therefore not spending on accommodation and other in-person services.

Australia’s ELICOS industry has lost some AUS$1.94 billion (82 per cent) in value since 2019, English Australia said.

Source regions: By world region, Europe had the largest decline in percentage terms with a 74 per cent decrease, followed by the Americas (-63), the MENA region and Sub-Saharan Africa (-58) and Asia Pacific (-50).

During the seminar, Brett observed that Europe tends to have higher volumes of working holiday students typically, and said that there had been less appetite for online delivery from the region.

Meanwhile, the report authors noted that the possibility to work while studying is a key driver for Latin America, meaning that students from this region either deferred of chose another destination in 2021.

Asia Pacific, as traditionally the largest source region for Australia’s ELICOS providers, had the largest decrease in absolute numbers, but the impact was lessened by some success in online delivery in China, Japan and Korea.

Source markets: China remained the largest source country for ELICOS providers in 2021, despite a 47 per cent decrease in student numbers compared with the previous year to 9,892, while Colombia held second place (4,156 students, -61 per cent), and Japan was third (2,920 students, -65).

With the smallest year-on-year decline among top ten source countries at 35 per cent, Nepal rose from seventh to fourth-largest source market in 2021 with 2,341 students, leapfrogging Brazil and South Korea in the process.

Actual growth markets for ELICOS providers in 2021 were Indonesia (+10 per cent), the Philippines (+7), Nigeria (+74), Kuwait (+152) and Zimbabwe (+171).

Declines in student numbers by source region in 2021. Source - English Australia/Bonard.

Declines in student numbers by source region in 2021. Source - English Australia/Bonard.

Visa type: Student visa holders accounted for 74 per cent of English language students in 2021, while other/no visa students commanded 24 per cent, mainly due to the growth in online, offshore students. The other/no visa group only accounted for nine per cent in 2020, and never more than six per cent previously.

The decline has been most apparent in the visitor visa and working holiday visa cohorts, which both accounted for only one per cent of students in 2021, compared with 20 per cent and six per cent respectively in 2019.

Provider type data: By provider type, universities accounted for the largest cohort of ELICOS English language students at 38 per cent, followed by VET providers (31) and stand-alone private ELICOS schools (27).

The authors noted that universities had the highest proportion of students with other/no visa at 32 per cent, and cited partnerships with local universities and the success of online pathway programmes as factors in this.

Brett Blacker, CEO of English Australia, speaking during the data presentation webinar.

Brett Blacker, CEO of English Australia, speaking during the data presentation webinar.

States: By state, Queensland had the largest year-on-year decline in student numbers at 66 per cent, followed by Victoria (-57) and New South Wales (-52). South Australia had the lowest drop last year at only 35 per cent. The authors noted that Queensland typically has the highest proportion of non-student visa students, and as such was the most impacted state.

Recruitment methods: Agents accounted for 88 per cent of students enrolled in 2021, a higher ratio than the previous year (82 per cent), demonstrating that the move towards online, offshore delivery has not dented Australia’s reliance on the agency sector for student recruitment.

By state, providers in New South Wales had the highest reliance on agencies at 90 per cent of enrolments, while by provider type secondary schools (99 per cent) and VET providers (91) had the highest ratios of agent-based recruitment for students in 2021, although all school types recruited at least 84 per cent of students via agencies.

Student location: Some 80 per cent of students in 2021 were actually offshore and outside of Australia, English Australia said, and 95 per cent of providers surveyed offered online programmes in 2021.

Brett said that there had been some market diversification as a result of online delivery breaking down some traditional barriers, particularly in some African markets.

Online plans: More than half of colleges surveyed intend to continue with online delivery in some form, the research showed. Fifty-nine per cent said they would offer a hybrid model if feasible; 53 per cent said that would offer online courses as a supplementary product before a face-to-face course; and 51 per cent intend to offer online courses as a stand-alone, revenue-generating product.

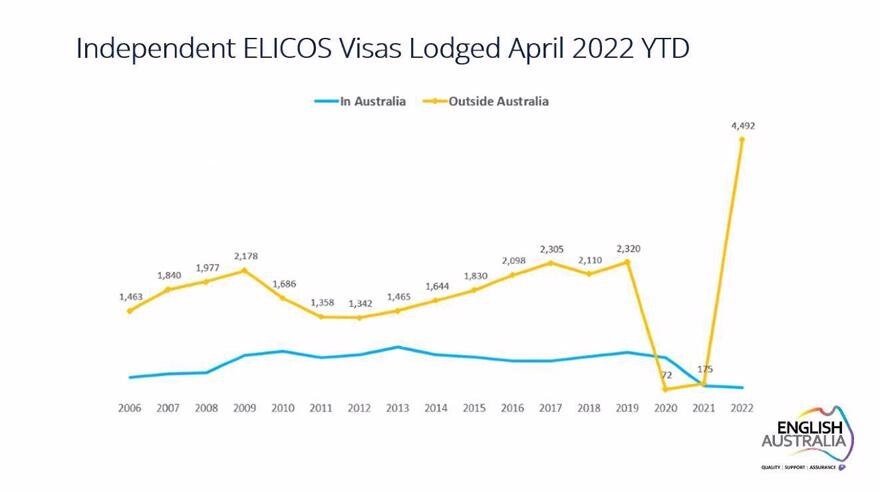

2022 recovery: Current year data shows some recovery for the ELICOS English language sector in terms of actual course commencements, while student visa applications suggest a strong pipeline.

The year-to-date Department of Education, Skills and Employment data for April 2022 showed the first increase in ELICOS commencements in two years at 4.4 per cent (student visa holders only), and Brett gave a preview of the soon-to-be-released May 2022 data showing a 19.6 per cent increase in ELICOS commencements.

Strong growth in the year to April has come from Thailand (+374 per cent), as well as Brazil (44.4), Japan (42.9) and Vietnam (23.1).

Meanwhile, the number of independent ELICOS student visa applications lodged outside of Australia by the end of April stood at 4,492, double the rates typically seen in the pre-pandemic years.

The increase in ELICOS visas lodged in year-to-date April 2022. Source - English Australia/Department of Home Affairs.

The increase in ELICOS visas lodged in year-to-date April 2022. Source - English Australia/Department of Home Affairs.

Overall visa lodgements across all study sectors have increased by 111 per cent in the year up to April, compared with the same period of last year, Brett said.

In response to a question on recovery in the annual survey, ELICOS providers project around 42 per cent of pre-pandemic volumes in 2022, rising to 55 per cent next year and 80 per cent in 2024.

The Executive Summary to the English Australia National Elicos Market Report 2021 will be available at this link soon.

At the time of writing, AUS$1 = US$0.69.