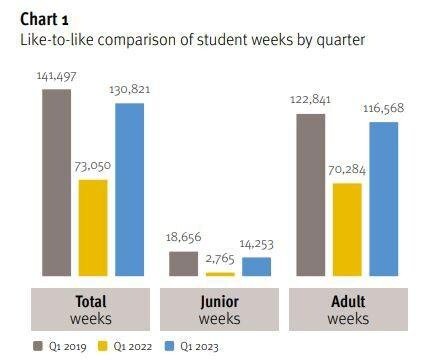

2023 Q1 vs 2019 Q1: For the centres who participated in QUIC in 2019 and 2023, overall student weeks in Q1 2023 were at 92 per cent of the 2019 Q1 total. Adult student weeks had almost fully recovered at 95 per cent, although the junior segment lagged behind at 76 per cent.

Overall for the 123 QUIC 2023 Q1 schools, 150,270 student weeks were delivered, of which 89.1 per cent were for adults.

Student weeks comparison of Q1 in 2019, 2022 and 2023. Graphic source – English UK/Bonard, Quarterly Intelligence Cohort Q1 2023

2023 Q1 vs 2023 Q1: In comparison with the previous year, 2023 Q1 student weeks 79.1 per cent higher than 2022 Q1, while adult weeks were up by 65.9 per cent and junior weeks increased by 415.4 per cent.

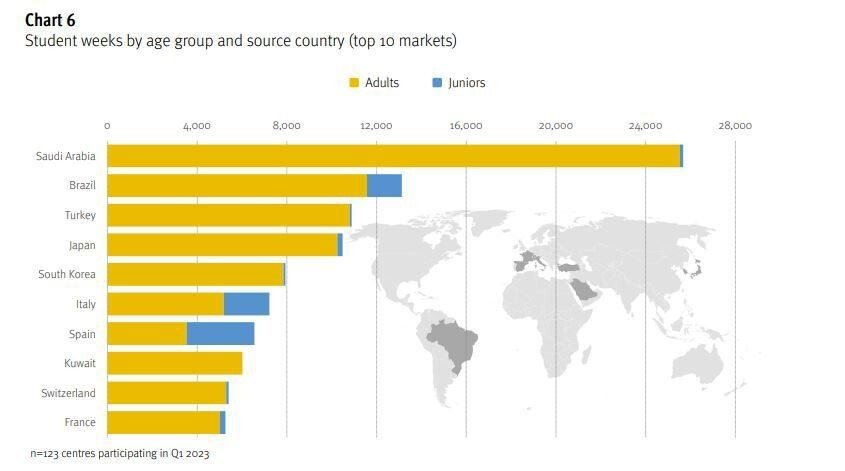

Source markets: Saudi Arabia is the traditional top source market for the first three months of the year, and provided 25,671 student weeks for QUIC participant schools in 2023 Q1. Brazil, which was the fourth largest source in 2019 Q1, jumped to second-largest source in the most recent quarter. The top five in 2023 Q1 was completed by Turkey, Japan and South Korea.

For junior student weeks in 2023 Q1, Spain overtook the traditionally largest source Italy, while Argentina grew to become the third-largest junior source market.

StudyTravel Magazine has recently written about growth and optimism in the Brazilian and Argentine outbound markets, based on surveys by the respective agency associations BELTA and ARSAA .

Recruitment channels: In terms of recruitment channels, 78 per cent of student weeks in 2023 Q1 were attributable to agents, a slightly higher ratio than the 76 per cent recorded in 2019 Q1.

Groups accounted for 16 per cent of student weeks in 2023 Q1, an increased share compared with nine per cent in 2022 Q1 and the highest Q1 ratio since 2019 when 20 per cent of student weeks came from group bookings.

Course types: In the adult segment, general English courses accounted for the vast majority of student weeks (92), followed by English for Academic Purposes (six). For juniors, 81 per cent of weeks were attributable to General English (higher than 74 per cent in 2019 Q1), while summer/winter camp courses accounted for 18 per cent.

Background: In 2022, the recovery of the UK ELT sector appeared to lag behind some of its major competitors. According to the full-year English UK report covering all member centres of the association, student weeks were around 60 per cent 2019 levels.

This compared with ELT schools in Malta which reached a record level of student weeks in 2022 and member schools of Marketing English in Ireland (MEI) Marketing English in Ireland which similarly achieved a record peak of weeks, even if student numbers were not fully recovered. Education South Africa (EduSA) schools were at around 70 per cent of pre-pandemic student weeks last year.

The top source markets for English UK centres in 2023 Q1 by student weeks. Source – English UK/Bonard.

The top source markets for English UK centres in 2023 Q1 by student weeks. Source – English UK/Bonard.

English UK recently launched a position paper at a special event at the House of Commons, calling on the government to support the recovery and growth of the UK ELT sector with specific measures including a group travel scheme for juniors, expansion of the working holiday scheme to include Europe and part-time work rights for long-term language students.

Click here to access the Executive Summary of the English UK QUIC 2023 Q1 report.

The Quarterly Intelligence Cohort scheme was launched by English UK in 2017 and is conducted in partnership with research partner Bonard.