Overall the 120 English UK member centres providing data for QUIC Q3 hosted 204,755 student weeks and represented 235 teaching centres, 182 of which were operational in this period.

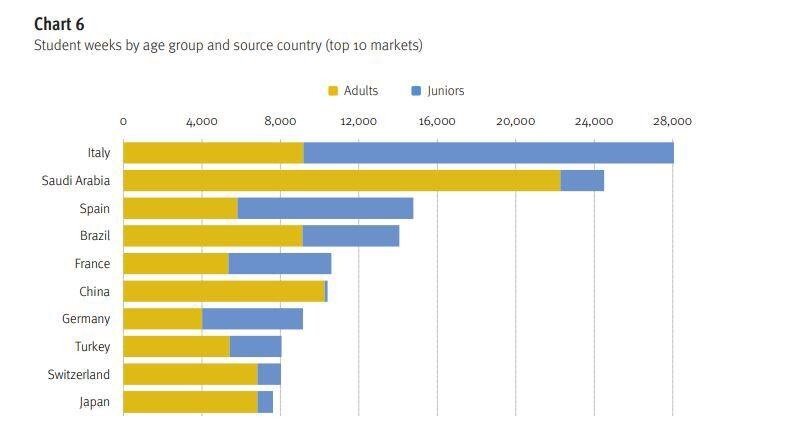

Top ten source markets by students weeks in 2022 Q3. Source – English UK/Bonard.

Top ten source markets by students weeks in 2022 Q3. Source – English UK/Bonard.

Patrik Pavlacic, Chief Intelligence Officer at Bonard, English UK’s research partner for the QUIC scheme, said, “After a period of two years, during which junior students were practically non-existing in UK ELT, Q3 2022 witnessed a strong rebound in the under-18 segment.”

Junior student weeks increased by some 3,254 per cent compared with 2021 Q3, while adult student weeks increased by 113.1 per cent.

Junior/adult ratio: In 2022 Q3, junior students accounted for 39 per cent of student weeks, a stark contrast with four per cent in 2021 and comparable with the 40 per cent ratio in 2019 Q3.

Groups/individuals: Similarly, group bookings were once again prominent in the UK ELT data, accounting for 36 per cent of student weeks in the July-to-September period of 2022, close to the 40 per cent level of 2019.

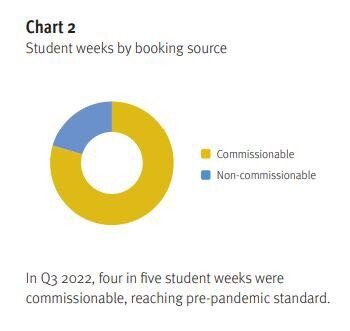

Booking channels: Agent-based recruitment increased slightly in 2022 Q3 to account for 80 per cent of student weeks, perhaps reflecting the return of the more agent-reliant junior segment and group business.

Source markets: In 2022 Q3, Italy returned to become the largest source market overall with 32,894 student weeks, and was by far the largest in the junior segment, accounting for 29.5 per cent of junior weeks.

Saudi Arabia was the second-largest source market with 24,507, almost double the same period in 2021 Q3. The top five was completed by Spain, Brazil and France. China, which had been the second-largest source in the summer of 2019, dropped to sixth place this summer.

Junior markets: After Italy, Spain accounted for the second-largest share of junior students at 11.2 per cent, followed by France (6.5) Germany (6.4) and Brazil (6.1).

Adult markets: In the adult segment, Saudi Arabia commanded 17.9 per cent of adult weeks, followed by China (8.2), Italy, (7.4), Brazil (7.3) and Japan (5.5).

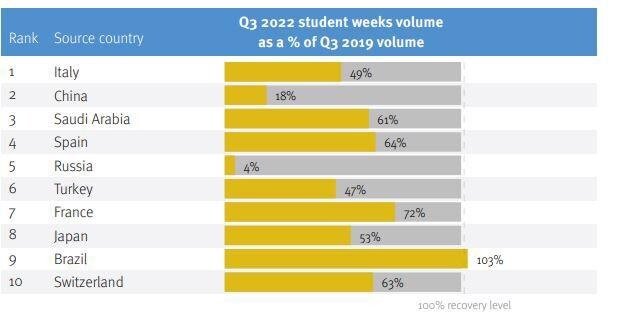

2022 vs 2019 recovery: The authors said that the recovery this summer was patchy, with some markets performing much better than others.

Source – English UK/Bonard/QUIC Q3

Source – English UK/Bonard/QUIC Q3

Germany reached 104 per cent of pre-pandemic levels in 2022 Q3, compared with 2019 Q3, while Brazil reached 103 per cent.

Most European markets reached more than 50 per cent of 2019 levels, including Spain (64) and France (72), but most of the top Asian markets were at around 19-49 per cent. China and Russia, which were among the top five source countries in 2019, recorded only 18 and four per cent of 2019 Q3 levels respectively.

Annie Wright, Joint Acting Chief Executive of English UK, welcomed the new figures. “We’re really pleased for our members – the Q3 data shows a real sense of recovery and is testament to their resilience and hard work. We will continue to support recovery with our lobbying work for a youth group travel scheme and our other campaigning work to help where our industry needs it most.”

The Quarterly Intelligence Cohort (QUIC) scheme was launched by English UK in 2017 to provide more timely and in-depth data for the UK ELT sector.