2025 was not just another year of fluctuation in international student mobility

It marked a structural reset shaped by policy shifts, affordability pressure, and changing student priorities.

Looking back at the data helps us understand not only what happened, but what student recruitment teams should prepare for next.

As 2025 draws to a close, we have been reflecting on how much has quietly changed in global student mobility over the past year.

This has not been just another post-pandemic adjustment.

Instead, 2025 feels like the point at which several long-running trends finally converged.

The data is clear: international education continued to growth but study destinations shifted

Over the past 12 to 18 months, a minimum of half a million international students have shifted away from the traditional “Big Four” study destinations of Australia, Canada, the United Kingdom, and the United States.

Europe and Asia absorbed a significant share of this redirection, recording some of the strongest growth globally.

This movement did not happen in isolation

In 2025, policy tightening across major study destination markets became increasingly visible.

Canada introduced ‘hard caps’ in 2024 that contributed to a year-on-year decline in international student enrolments, with study permit approvals falling to 262,100 nearly 48% below 2023 levels and around 100,000 permits short of the government’s own target. The cap has since been extended through 2026, with a new limit of 408,000 permits, more than half of which will be allocated to extensions for existing students rather than new entrants.

The United Kingdom saw a fall in new international entrants following changes to dependant rights in January 2024. Additionally, from 2027 government will shorten the Graduate Route from 24 months to 18 months.

In Australia, policy changes over the past two years have resulted in slower visa processing for some providers, tighter regulation of education agents, higher visa application fees, and increased financial requirements for international students. Despite hosting more than 497,000 international students in higher education, Australia has experienced a noticeable slowdown in new student applications.

Even the United States, while reaching record total international student enrolments, recorded declines in new commencements and graduate-level students. Data from the IIE’s Fall Snapshot Survey, based on responses from more than 825 US higher education institutions, shows a 12% decline in graduate international students and a 17 per cent fall in overall commencements for the 2025/26 academic year.

Economic pressure intensified across key source markets

Rising living costs, weaker currencies, and household affordability constraints increasingly shaped student decision-making.

For example, the Indian rupee weakened to historic lows in 2025, trading above ₹90 to the US dollar for the first time and even breaching the ₹91 mark in mid-December. This depreciation reflects a roughly 6 % year-on-year slide, making study costs denominated in dollars more expensive in rupee terms.

Students did not stop moving. Instead, they became more selective and more pragmatic.

Germany, Ireland, France, and Spain are attracting students specifically because of lower tuition, living costs, and clearer work pathways, as compared with traditionally expensive destinations such as the United States, the United Kingdom, Canada, and Australia

Emerging study destinations are no longer “alternatives”

One of the clearest signals from 2025 was the growing importance of emerging study destinations.

These countries are no longer secondary options; they are absorbing real demand.

Competitive pricing, more predictable student visa frameworks, regional proximity, and targeted English-taught programmes are making them increasingly attractive.

For example:

Germany hosted 402,000 international students in the 2024/2025 academic year, reaching a new record.

France reached 443,670 international students, a 3% increase between 2023/2024 and 2024/2025.

Japan recorded 21% growth year over year, hosting 336,000 international students and has committed to hosting 400,000 international students by the early 2030s.

South Korea’s international student population surpassed 300,000 in 2025, meeting its target two years ahead of schedule, with significant year-on-year growth.

These gains were not accidental. They reflected a mix of relative affordability, policy stability, and clearer study-to-work pathways at a time when uncertainty was rising elsewhere.

This raises a critical question:

Was 2025 a temporary correction, or a deeper shift?

The answer, based on the data, is that it is both.

Some student flows will return to the Big Four as governments adjust policies and education institutions respond.

However, a meaningful share of student mobility has already shifted structurally.

Once students, families, and student recruitment partners build confidence in alternative study destinations, those pathways tend to persist.

Europe’s position illustrates this well

But growth alone is not enough.

As we at BONARD Education have highlighted, Europe does not simply face a student recruitment opportunity; it faces a talent challenge.

With ageing populations and skills shortages across multiple sectors, the real question is not how many students Europe attracts, but how effectively it retains and integrates them into labour markets.

International education can no longer be viewed solely through the lens of student enrolments. It is increasingly tied to workforce planning, demographic sustainability, and long-term economic competitiveness.

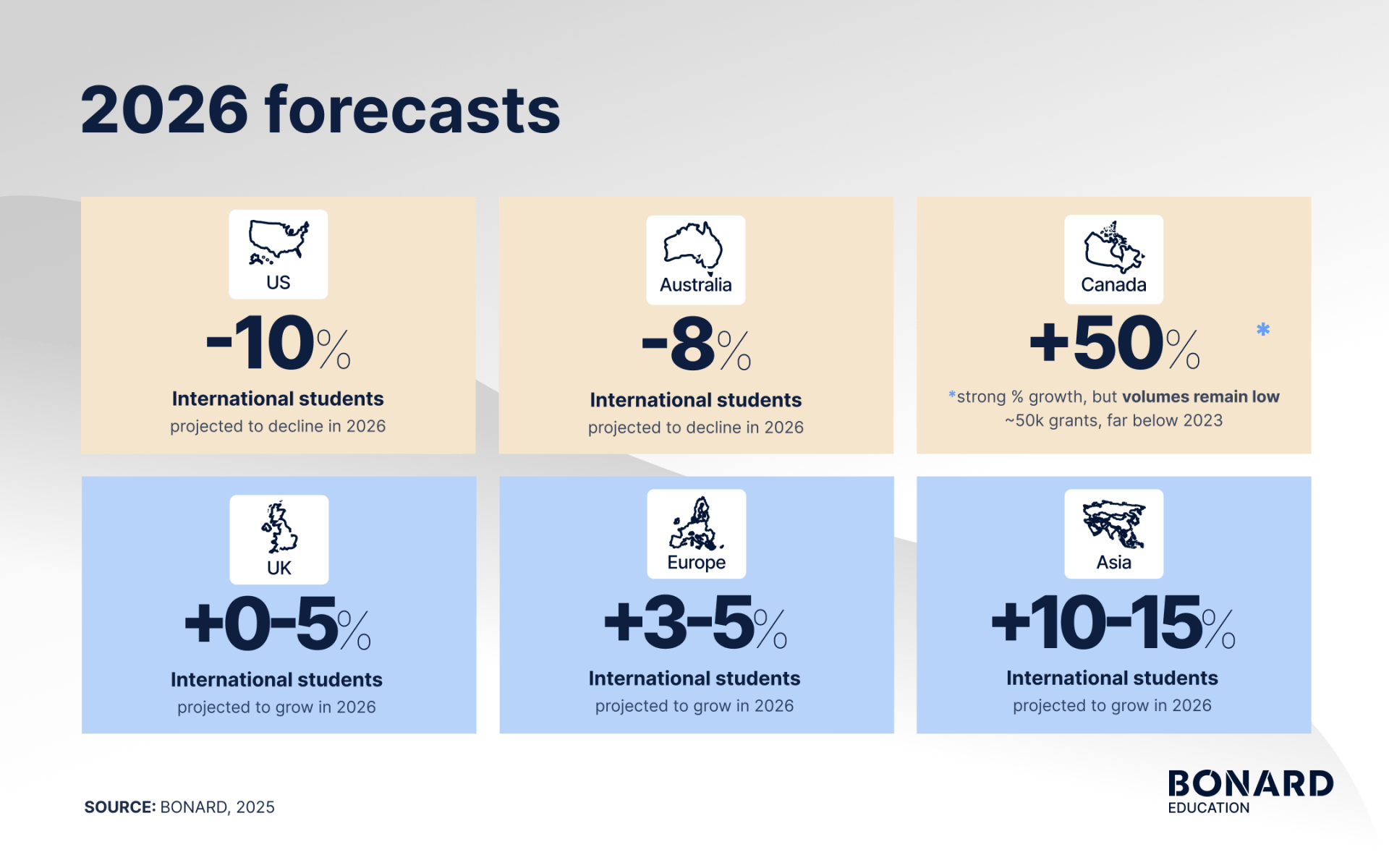

2026 outlook: what the data suggests

The global student mobility map is becoming more distributed and more complex.

No single group of study destinations can assume automatic growth.

Big Four: stabilising, but far below past levels

If we take into consideration data available as of November 2025, any “rebound” in the Big Four will be slow and uneven.

USA & Australia are expected to decline further in 2026

UK shows signs of stabilisation, with low single-digit growth

Canada may see strong percentage growth, but from a very low base, even with recovery, visa grants remain well below 2023 levels

Europe and Asia: where growth is actually happening

Europe is projected to grow by +3- 5% in 2026

Asia is expected to grow faster, at +10-15%, driven by regional mobility, improved quality of higher education and rise in university rankings, affordability, and clearer visa pathways

Note: This forecast reflects data on HE students only and policy settings available as of November 2025 and may be revised in response to changes in market conditions or destination-specific developments.

Note: This forecast reflects data on HE students only and policy settings available as of November 2025 and may be revised in response to changes in market conditions or destination-specific developments.

In many cases, future growth will come from higher-risk or emerging source markets, requiring better data, deeper partnerships, and clearer value propositions.

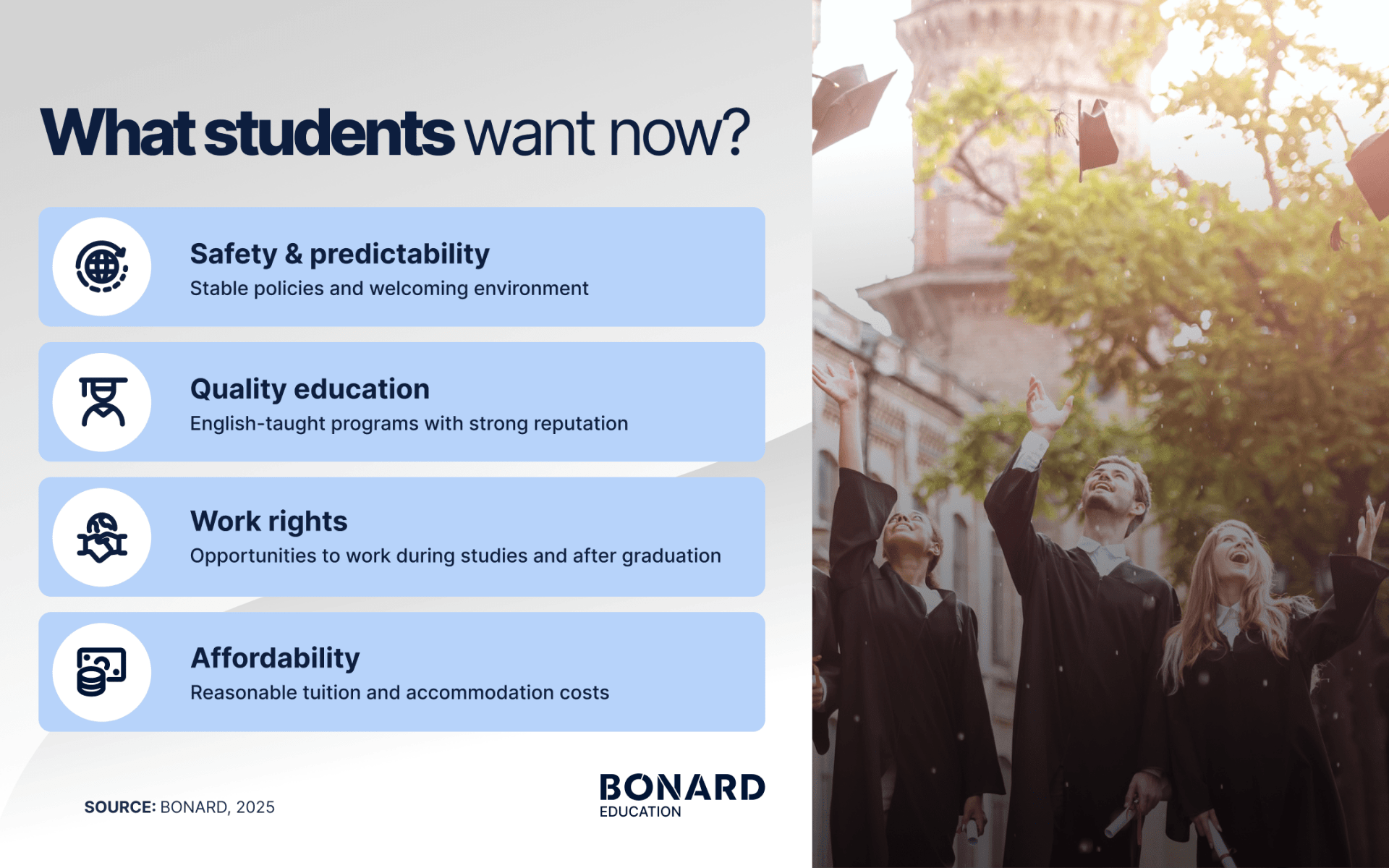

Students today are highly analytical

They are weighing cost, policy certainty, and post-study outcomes alongside reputation and aspiration.

What this means for international student recruitment teams in 2026

Diversification is no longer optional; it is risk management

Source market selection matters more than volume targeting

Visa clarity, cost, and outcomes now outweigh prestige alone

Looking ahead

2025 may not be remembered for a single dramatic announcement or policy decision. Instead, it is likely to be seen as the year the sector collectively recognised that old assumptions no longer apply.

The future of international education will not be defined by where students are expected to go, but by where it genuinely makes sense for them to study, build skills, and plan their futures.

At BONARD Education, we continue to track these shifts across source markets and destinations — helping institutions move from reaction to strategy.

Stay with us.

Happy holiday,

Ivana Bartosik

CONTACT FORM

Find out how we can cater to your specific needs

We look forward to assisting you further and explaining how our services can benefit you.