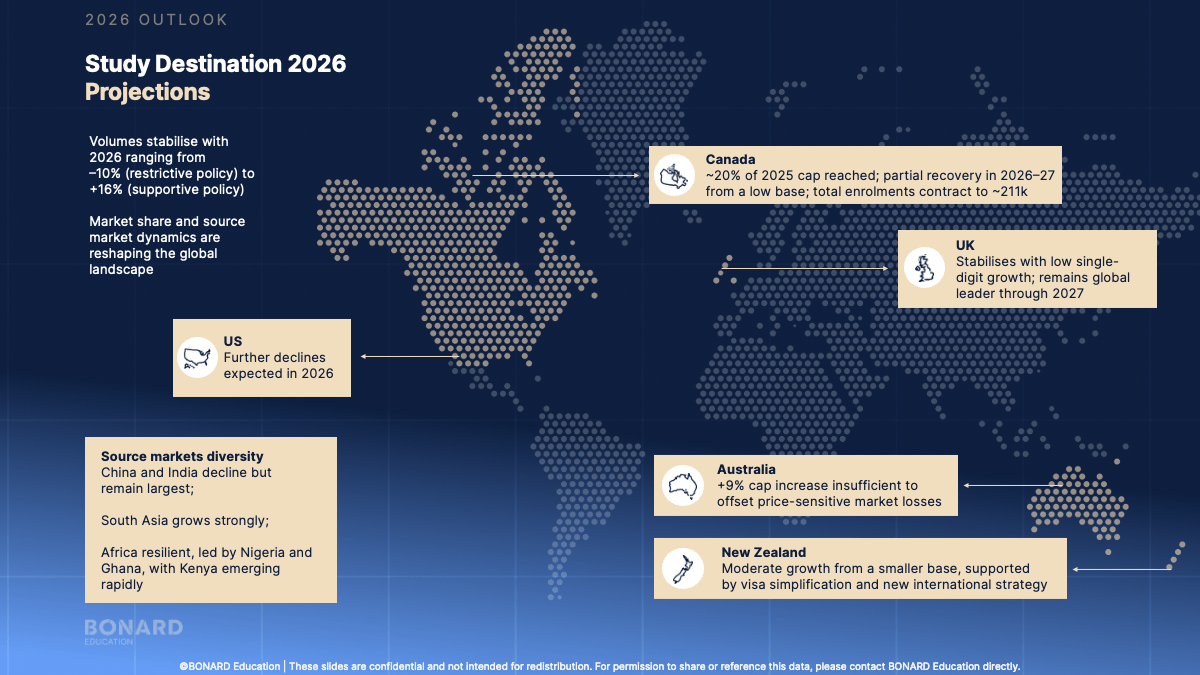

Global demand for international education continues to grow (~3% annually), but student mobility is being reshaped by policy, not preference.

2025 was not a collapse. It was a redistribution shock. Around 165,000 students changed study destinations due to student visa policy tightening, processing limits, and cost pressures.

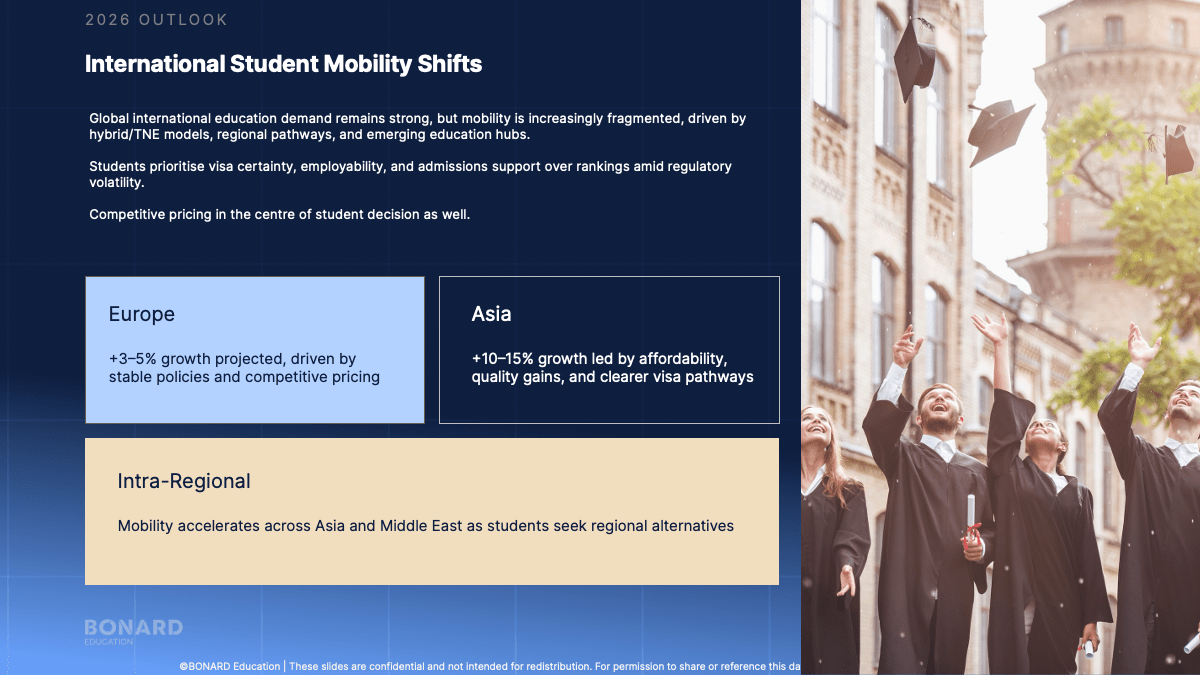

The result: fewer “default” study destinations, more fragmented and regionalised international student mobility, and rising importance of visa certainty, affordability, safety, and post-study work rights.

At the Q1 2026 edition of BONARD Education’s Global Student Flows Briefing, our research team revealed the latest student visa data in the 'Big 4' + New Zealand, powered by the BONARD Education Platform.

Study destination performance: what actually happened in 2025

Source market dynamics: what’s really shifting

India

Still the most important source market globally

Strong declines in Canada

Modest drops in Australia & NZ

Strong growth in the UK

China

Structural decline in outbound student mobility

Shift toward closer-to-home study destinations in Asia

Still resilient for the UK, Australia, NZ

Nepal & Bangladesh

Fastest-growing source markets, highly price- and access-sensitive

Rapid responders to policy changes

Japan & South Korea

Continued long-term softening

US as a source market

Surprisingly stable flows to UK & Canada

"International student mobility is not disappearing.

It is rebalancing toward certainty and proximity"

Structural trends shaping 2026+

Fragmentation of student pathways

Rise of regional hubs (Asia, Europe, Middle East)

Growth in TNE and hybrid models

Europe projected +3–5% annually

Asia projected +10–15%, driven by affordability and clarity

Students behaving more like risk managers than aspirational shoppers

Strategic implications for institutions

This briefing quietly delivers a sharp warning:

Source market diversification is no longer optional

Over-reliance on a single study destination or source market is now a structural risk

Student recruitment strategies must prioritise:

Student visa success rates

Cost-value balance

Student work rights & employability

Trusted agent networks

The winners in 2026 will be those who plan for policy volatility, not “post-pandemic recovery”

The BONARD Education Platform helps institutions benchmark student visa performance, map enrolment data, evaluate market potential, and make informed international student recruitment decisions.

Q1 2026 GLOBAL STUDENT FLOWS BRIEFING

Webinar Recording

Missed the live session? The full recording is available for subscribers or upon request (via the form below).

CONTACT FORM

Recording and presentation - request form

Access the latest international student mobility trends by submitting this form

Do you want to learn more about the presented data? Explore our data platform - the most advanced source for international education market intelligence.

Access previous Global Student Flows Briefings