Thank you for your trust in 2025.

As we move into 2026, we remain committed to providing timely, data-driven insights to support informed international student recruitment decisions in an increasingly complex environment.

Global demand for international education continues to grow at around 3% per year. However, it is now policy, rather than student preference, that plays the decisive role in where students enrol.

2025 was marked by a redistribution. An estimated 165,000 students redirected their study plans away from the Big Four in response to tighter student visa regimes, processing backlogs, and rising cost pressures.

The result is a clear structural shift: traditional study destinations should not rely on their automatic appeal, international student mobility is becoming more fragmented and regionalised, and factors such as visa predictability, affordability, safety, and post-study work opportunities are increasingly decisive.

What we expect in 2026

Based on current data, we anticipate:

Greater fragmentation of student pathways

Continued rise of regional education hubs (Asia, Europe, Middle East)

Stronger growth in TNE and hybrid delivery models

+3–5% growth in international students choosing Europe

+10–15% growth in Asia, driven by affordability and policy clarity

Students behaving more like risk managers than aspirational shoppers

To remain competitive in this environment, we advise education providers to:

Diversify international student portfolios

Avoid over-reliance on any single study destination or source market

Regularly monitor:

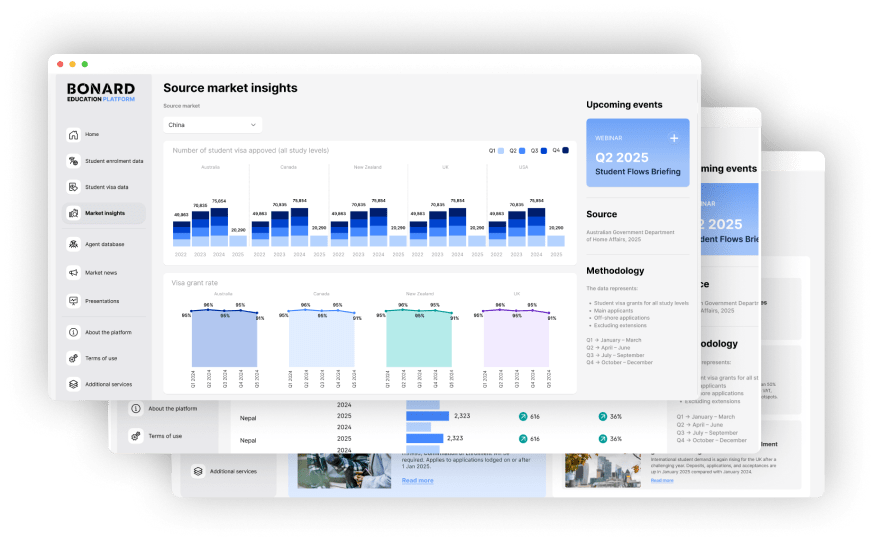

Student visa approval rates

Cost–value balance

Work rights and employability

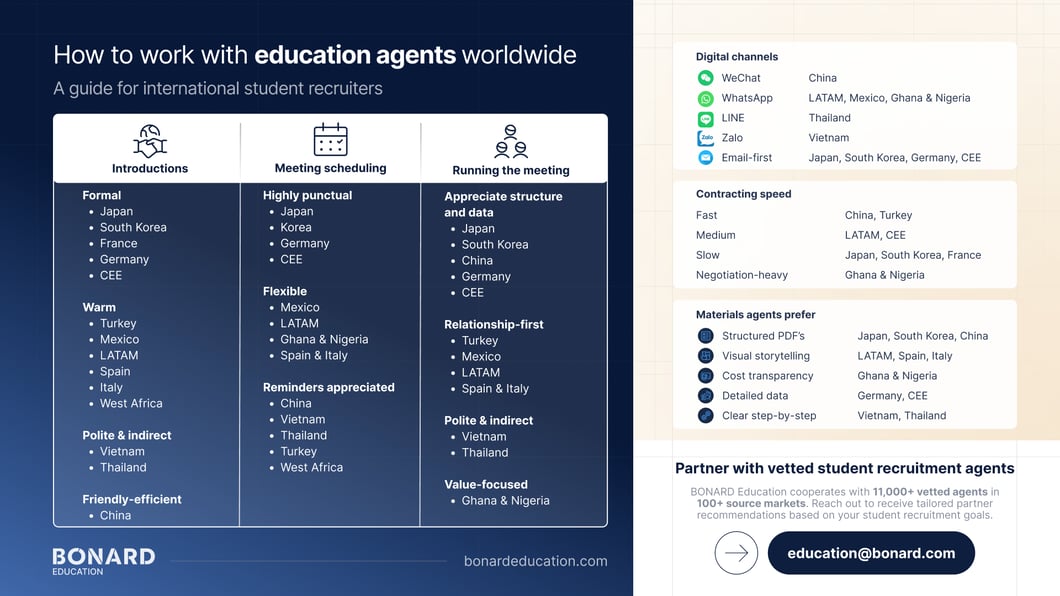

Trusted agent networks

In 2026, the institutions that succeed will be those that plan proactively for policy volatility, not those waiting for a return to post-pandemic norms.

We explore these insights in more detail in the Q1 2026 edition of BONARD Education’s Global Student Flows Briefing. You can access the presentation and recording below.

The new US visa restrictions are accelerating student flow re-routing

Recent US visa announcements have triggered a significant re-routing of international student demand.

Rather than reducing overall interest in the US as a study destination, current developments are reshaping who applies, when, and from where.

What is changing

20 nationalities are now subject to a full suspension of student visa issuance, with partial suspensions applied to an additional 75 countries

new restrictions extend to F, M and J visa categories, affecting both first-time applicants and, in some cases, extensions

processing times remain unpredictable, increasing uncertainty for institutions and applicants alike

Early impact on US higher education

2025 is expected to see a 30% decline in new higher education intakes, driven largely by the suspension of visa interviews in June 2025 and the slow recovery of Indian applications

2026 is unlikely to deliver the stabilisation many had hoped for, and any meaningful recovery now appears to be a mid- to long-term prospect rather than an imminent turnaround

What this means for US institutions

This is not a collapse in global demand, but an acceleration of student flow re-routing. Institutions will need to move away from broad, one-size-fits-all student recruitment approaches and adopt source market-specific strategies, aligned with visa accessibility, application timing, and post-study pathways.

As policy volatility increases, continuous monitoring of visa trends and proactive adjustment of student recruitment priorities will be essential to managing enrolment risk.

Meet BONARD Education at

Meet our team and join our sessions at the upcoming conferences

Languages Canada Annual Conference

11-14 March 2026,

Calgary, Canada

News You Should Not Miss

Latest headlines from the BONARD Market Monitor

Stay informed via our Market Monitor and receive the latest industry news in your mailbox daily

CONTACT FORM

Find out how we can cater to your specific needs

We look forward to assisting you further and explaining how our services can benefit you.