China: employability outcomes top of mind for students

The latest BONARD webinar tracked trends in China, a recovering market where competitiveness is increasing and destination preferences are shifting.

Driven by uncertain economic conditions post-pandemic and an increasingly competitive job market, Chinese students are focusing on future employability prospects when choosing a study program abroad.

This is what emerged from the latest BONARD Source Market Webinar: Recruiting Students from China.

Presenting the latest data, Su Su, Senior Project Consultant at BONARD’s China Branch, explained that “the so-called Return On Investment is a term I hear mentioned more and more by parents and students when planning overseas studies. Parents will consider affordability and employability when choosing a school and will appreciate internship opportunities in local companies.”

Su Su, BONARD

Su Su, BONARD

More than 80% of Chinese international students seek employment in China after completing a degree abroad.

Rona Wu, manager of the Global Partnership Centre at Shinyway International, one of the panel speakers, explained that Chinese students face a very competitive job market when they return home, adding “employability prospects are the main reason for them to choose a university.”

Rona Wu, Shinyway International

Rona Wu, Shinyway International

As outbound student mobility from China is on a “slow but steady” recovery trajectory after the pandemic, the market is becoming more and more competitive for overseas institutions.

The webinar audience was advised that educators seeking to engage with the Chinese market need to consider the factors driving students’ decisions. In terms of employability, institutions should consider not only offering internships but also incorporating employability skills into the curriculum and partnering with industry, according to Joshua Gabriel, Senior Programme Manager at the British Council China and another panel speaker.

Other factors driving students’ – and their families’ – decisions are affordability, safety, and, of course, rankings.

“The combination of rankings and strong employability outcomes are key drivers at the moment,” summarised Patrik Pavlacic, BONARD’s Chief Intelligence Officer, who chaired the panel discussion.

Patrik Pavlacic, BONARD

Patrik Pavlacic, BONARD

Mingze Sang, president of BOSSA (Beijing Overseas Study Service Association) and another panel speaker, commented that costs can sway decisions at every stage of the process.

“Scholarships may help, and they always affect the final decision, when students have the offer,” he said.

Mingze Sang, BOSSA

Mingze Sang, BOSSA

However, he also observed that at the beginning of the planning process, students will consider other aspects, such as tuition fees and cost of living, when choosing their destination.

Presenting the latest data and a panel discussion with experts in the Chinese international education sector, the webinar provided a comprehensive overview of the trends shaping demand for studying abroad in the ELT, K–12, and higher education sectors in China. Here are some of the other key takeaways.

A slow but steady recovery

“Overall, the China market is still recovering but at a slower pace compared to other markets. However, we should not ignore the market's great potential,” Su Su explained.

Su Su, BONARD

Su Su, BONARD

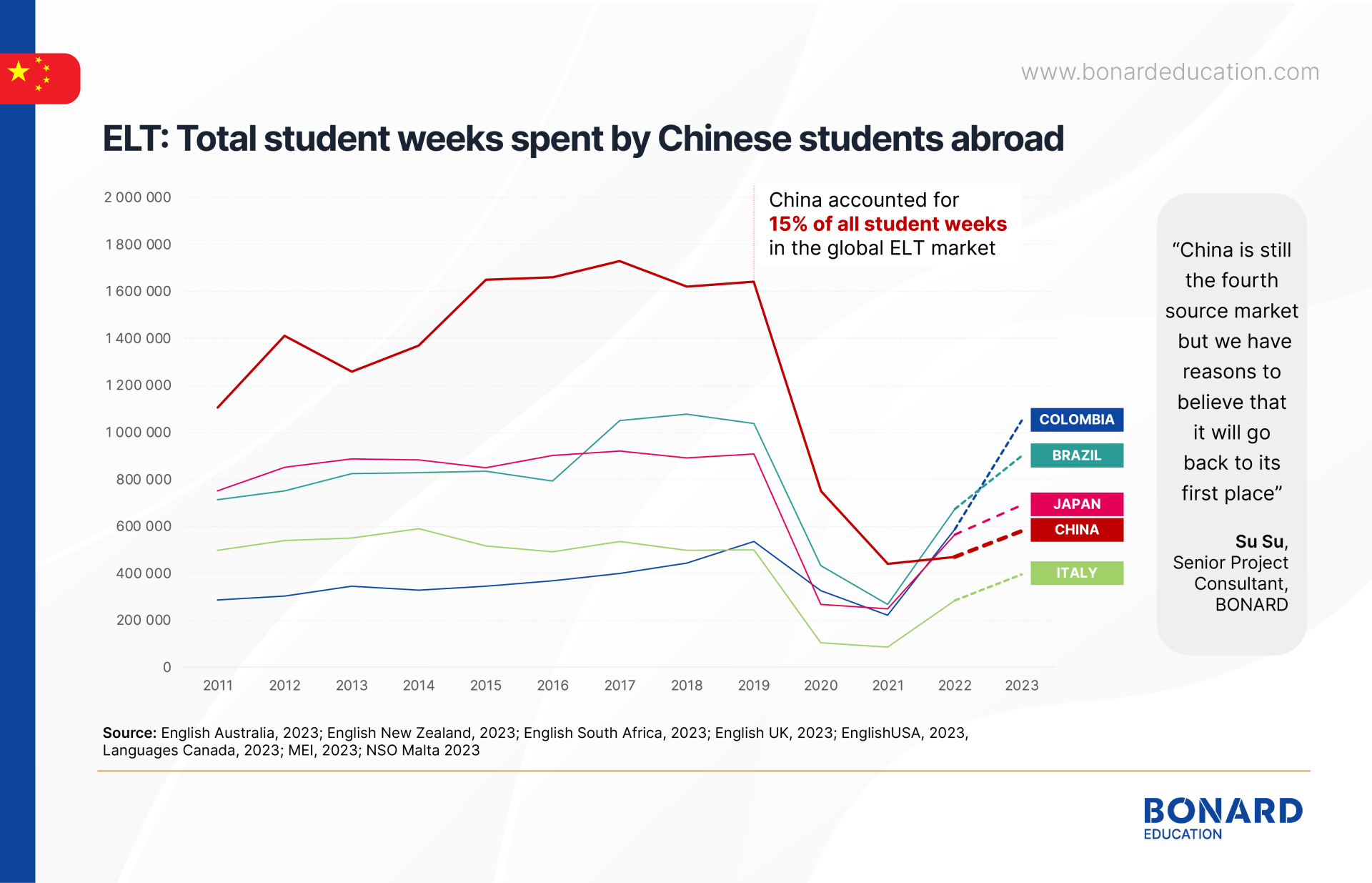

Presenting the data, Su Su observed that all three segments of the market (K–12, ELT, and higher education) are growing. While they have not yet recovered to pre-pandemic levels in some countries, the outlook is positive.

Talking about the ELT sector, Su Su explained that “China is still the fourth source market, and we have reasons to believe that it has the potential to go back to its first place.”

Members of the audience were more cautious. Asked about their recruitment expectations for the year ahead, 37% of respondents said they were expecting to recruit a similar number of students from China as in 2023, and 30% said they expected more.

Mingze Sang, president of BOSSA (Beijing Overseas Study Service Association) and another panel speaker, commented that costs can sway decisions at every stage of the process.

“There are reasons to be optimistic, but the market sentiment is still conservative,” Pavlacic commented.

Patrik Pavlacic, BONARD

Patrik Pavlacic, BONARD

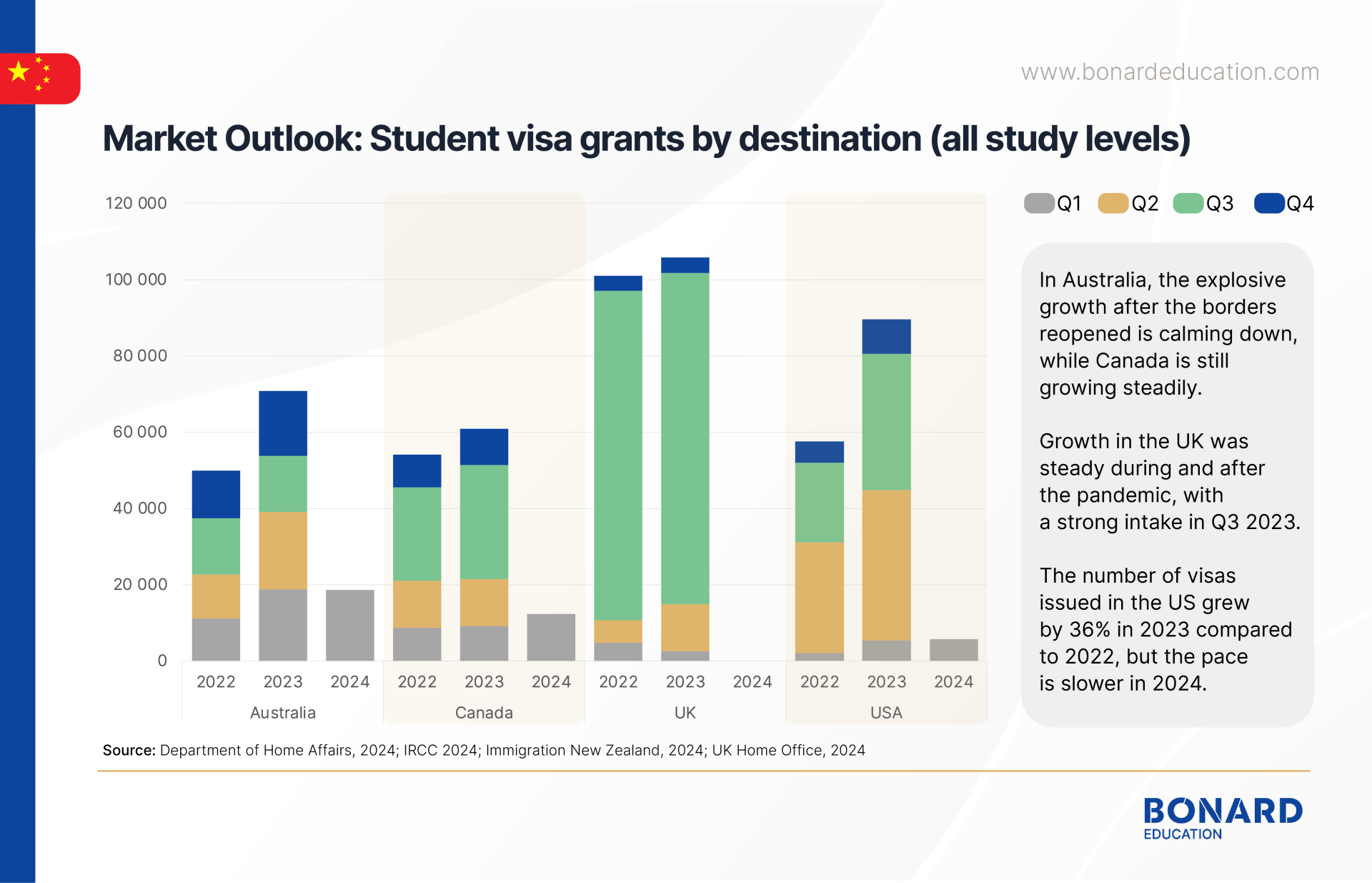

Pavlacic also presented data on the number of student visas granted to Chinese students in the major study abroad destinations.

Using data from the Visa Tracker, a new service in BONARD’s portfolio, Pavlacic commented that the market is enjoying steady recovery.

In Australia, the explosive growth seen after the borders reopened is calming down, while Canada is still growing steadily. Growth in the UK was steady during and after the pandemic, with a strong intake in Q3 2023. The number of visas issued in the US grew by 36% in 2023 compared to 2022, but the pace is slower in 2024.

A question to consider is how restrictive policies in study destinations will affect student flows. Pavlacic explained that institutions in countries where restrictive policies have been implemented are concentrating recruitment efforts in countries with high visa approval rates.

“With China’s visa approval rates being consistently high, competition in the market is increasing,” he explained.

New destinations on the map

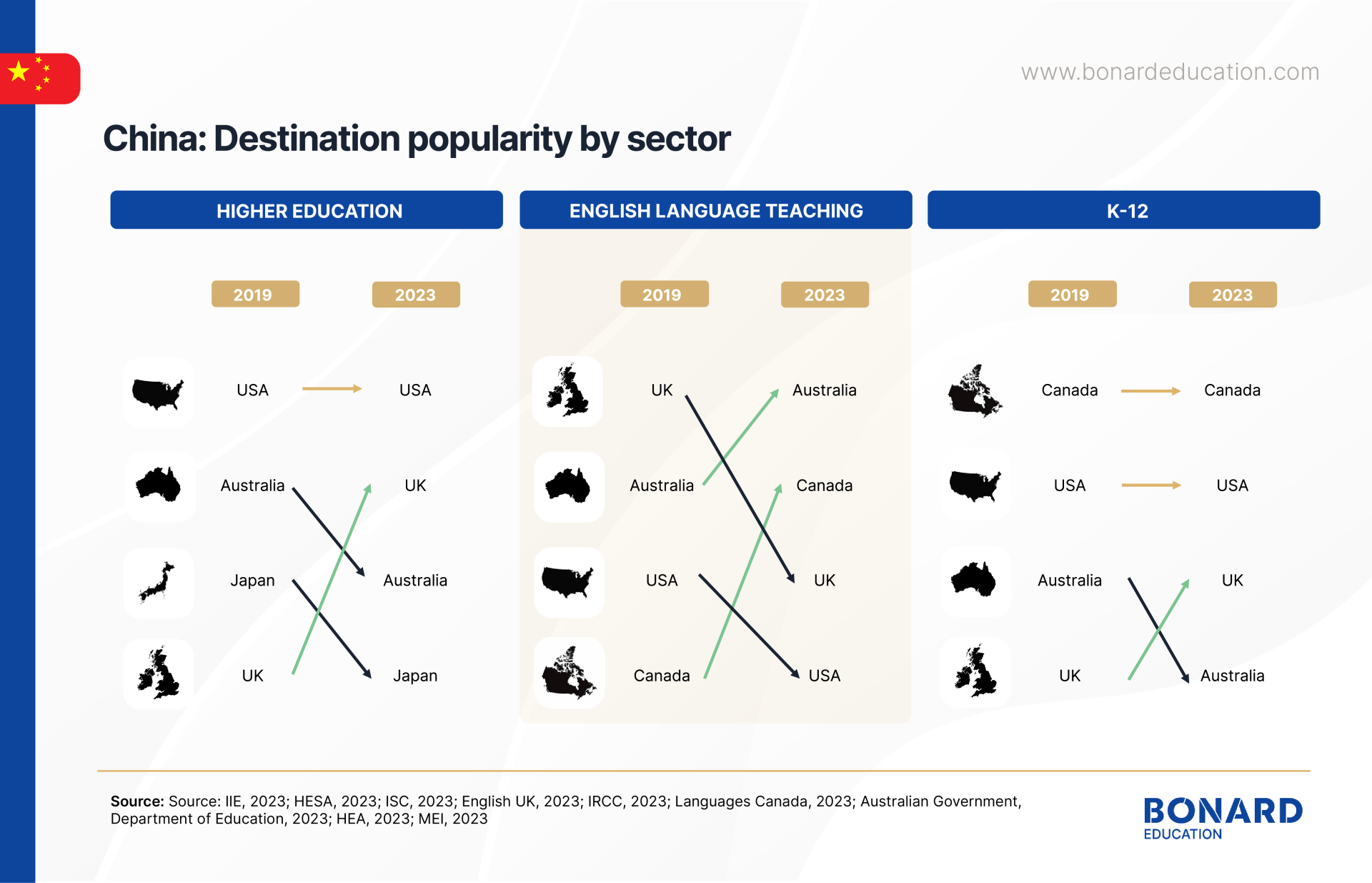

According to the data presented during the webinar, destination preferences in the K–12 sector have remained relatively stable, with Canada at the top, followed by the US and the UK – although agents are telling BONARD that the UK gained considerably in popularity during and after the Covid crisis.

For university students, the most popular destination remains the US, but the UK snatched the second position from Australia, which now ranks third, between 2019 and 2023.

There were significant changes in destination popularity for English language students between 2019 and 2023. The UK fell from first to third position, and the US from third to fourth, while Australia and Canada gained in popularity: Australia rose from second to first destination, while Canada soared from fourth to second.

Intraregional mobility is also growing after gaining traction during the pandemic. However, it should not pose a threat to traditional study destinations, according to panel speakers.

Sang explained that “[Asian destinations] have risen in popularity in the past few years, but I don’t think they are going to impact the rest of the industry too much. Let’s look at Hong Kong and Singapore – their capacity to welcome international students is relatively limited, and the majority of students are still looking for traditional destinations such as the UK, US, Australia and Canada.”

Mingze Sang, BOSSA

Mingze Sang, BOSSA

Gabriel agreed, predicting that “traditional destinations will continue to draw significant numbers of students from China.”

Joshua Gabriel, British Council

Joshua Gabriel, British Council

Targeted promotion and local agents are key

Another audience poll question asked attendees what challenges they encountered when recruiting students from China. The most popular answer, attracting 42% of responses, was finding and maintaining suitable agent partners.

However, forging partnerships with local agencies is crucial, being the key to successfully promoting an institution to students and their parents.

As Su Su explained, “China is a big country; people in different regions have different preferences. Parents and students can be strongly influenced by what is promoted.”

Fruitful partnerships with institutions are also something that agents in China appreciate. “I always hear from agencies that programmes are replaceable, but partnerships are not,” Su Su said. However, she also warned that “agents have a lot of choice, so they are always careful when choosing their partners.”

Su Su, BONARD

Su Su, BONARD

Giving his recommendations for overseas institutions, Gabriel spoke of the need for “universities … to invest in travel and meet the agents in person.”

This is just a taste of what was covered in the webinar. To request the presentation slides or a recording of the webinar, please contact china@bonard.com.

Access the webinar landing page by clicking here.

Webinar Recording

After a presentation of the latest statistics by Su Su (Senior Project Consultant at BONARD's China Branch), Patrik Pavlacic (Chief Intelligence Officer at BONARD) led a panel discussion joined by Mingze Sang, President at BOSSA, Rona Wu, Manager of Global Partnership Centre at Shinyway International, and Joshua Gabriel, Senior Lead for Culture and Education at British Council China.

CONTACT FORM

Presentation - Request form

Get closer to students in China, one of the top student recruitment source markets. Maximise your success in the international education market with us.

To further explore particular international education data and opportunities in China, please request to speak with one of our experts at china@bonard.com.